Merger arbitrage must-knows: A typical stock merger spread

Not all deals are cash deals, however. Often companies will issue stock in lieu of giving cash for a deal. This adds a layer of complication to the process and also some risk factors we need to consider.

April 29 2015, Updated 4:53 p.m. ET

The typical stock merger spread

Not all deals are cash deals, however. Often companies will issue stock in lieu of giving cash for a deal. This adds a layer of complication to the process and also some risk factors we need to consider. Here are the things that will drive a risk arbitrage spread for a stock deal.

- The probability of closing

- Hostile or friendly

- Strategic buyer or private equity

- The time it will take to close the deal

- The downside if the deal breaks

- Any dividends during the pendency of the deal

- The probability of a higher bid

- Tax implications of the deal

- The need for a vote on the acquirer

- The cost to borrow the acquirer’s stock

- Any dividends you are short

- Cash and stock election

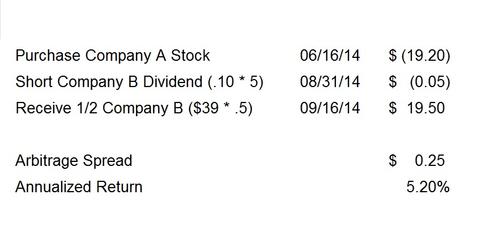

So, let’s use the same deal idea as before. Company A agrees to a merger with Company B and you see the deal in the Wall Street Journal on Monday morning. Company A’s stock closed Friday at $15 a share, and Company B’s stock closed Friday at $40 a share. Company A’s stock will exchange for 0.5 shares of Company B’s stock. Let’s also assume Company B pays a 10 cent dividend. On Monday morning, Company B is trading for $39 a share. Where should Company A trade? Well, you’re going to get 0.5 shares of Company B, which is trading at $39 a share, so you’ll get $19.50 a share. However, you’re going to be short a ten cent dividend over the course of the deal, so that takes another nickel out of the spread. So your proceeds from the deal are going to be $19.45, which means Company A will probably trade around $19.20 or so.

Current deals

Right now, the biggest deals on Wall Street are between Time Warner (TWC) and Comcast (CMCSA) and between DirectTV (DTV) and AT&T (T). Investors who want to invest in M&A deals via an ETF should look at the IndexIQ ETF (MNA).

For access to premium risk arbitrage content, please email singh@marketrealist.com.