IQ Merger Arbitrage ETF

Latest IQ Merger Arbitrage ETF News and Updates

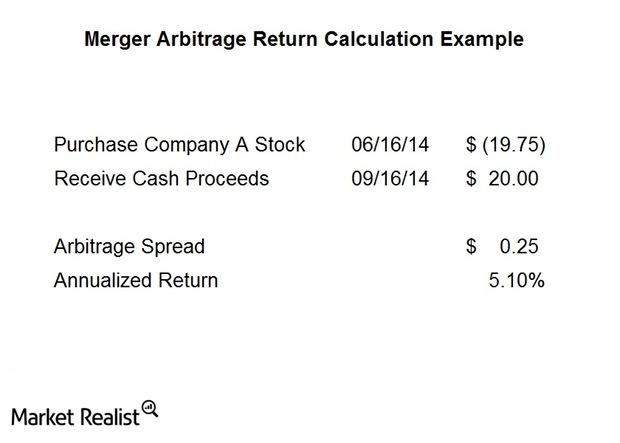

Identifying and analyzing a typical cash merger arbitrage spread

What are the components of a risk arbitrage spread? There are a number of factors that figure into a trade. Let’s look at a typical cash deal first.

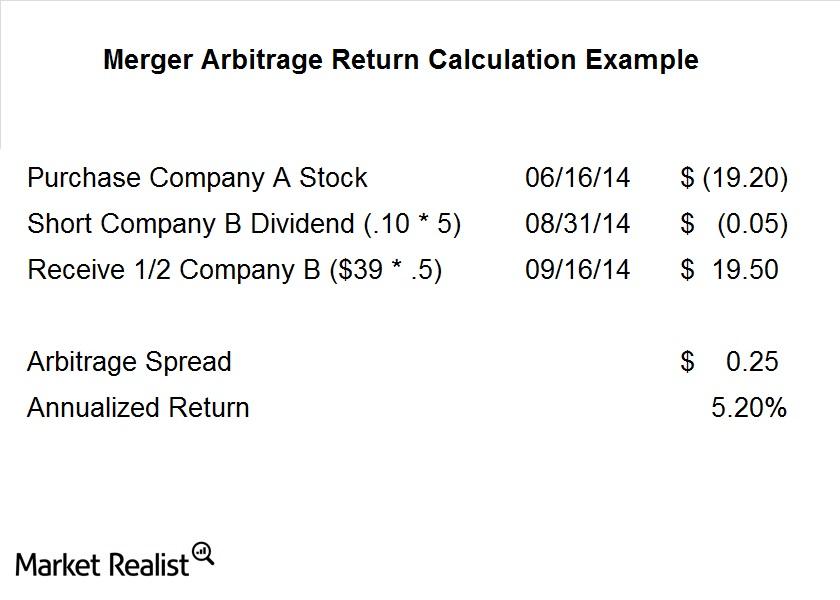

Merger arbitrage must-knows: A typical stock merger spread

Not all deals are cash deals, however. Often companies will issue stock in lieu of giving cash for a deal. This adds a layer of complication to the process and also some risk factors we need to consider.

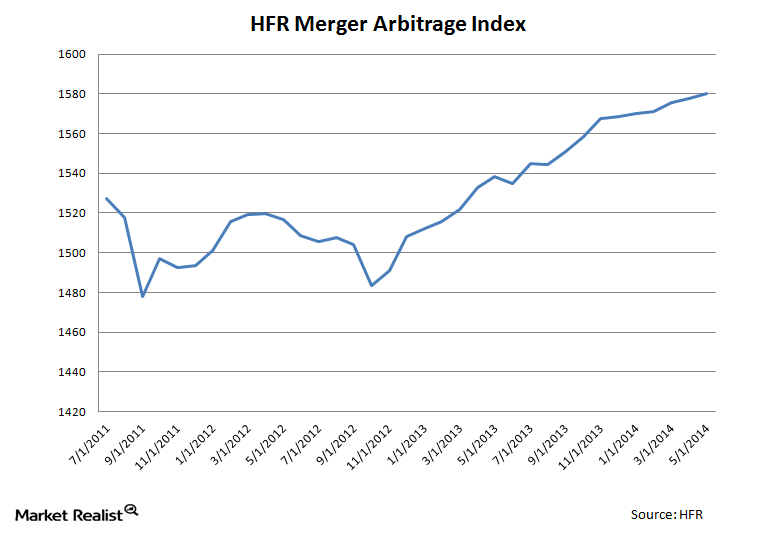

Merger arbitrage must-knows: A key guide for investors

Merger arbitrage, otherwise known as “risk arbitrage,” is an investment strategy that primarily focuses on mergers and capturing the spreads on announced deals.