Merger arbitrage must-knows: A key guide for investors

Merger arbitrage, otherwise known as “risk arbitrage,” is an investment strategy that primarily focuses on mergers and capturing the spreads on announced deals.

June 17 2014, Published 2:47 p.m. ET

What is merger arbitrage?

Merger arbitrage, otherwise known as “risk arbitrage,” is an investment strategy that primarily focuses on mergers and capturing the spreads on announced deals. This strategy falls within the category of event-driven investing, which exploits inefficiencies that can occur before or after events including mergers, spinoffs, and bankruptcies.

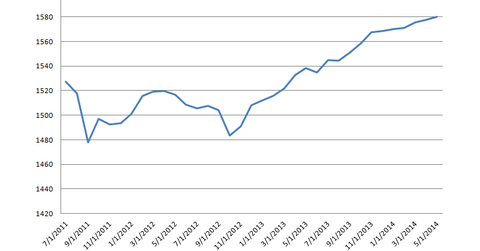

The chart above is of the HFR Merger Arbitrage Index, which tracks the returns of merger arbitrage hedge funds.

What is arbitrage?

In the simplest sense, “arbitrage” means buying securities in one market and immediately selling them in another in order to profit from a price difference. The trader would sell the overpriced security and buy the underpriced security to capture a spread. Once the prices of these securities revert to fair value, the trade can be unwound.

Merger arbitrage example

When an acquirer announces a merger, it bids for a target (the company being bought) using an offer price. This offer price is usually higher than the target’s unaffected price before the bid. The difference between the offer price and the unaffected price is called the “control premium” or “takeover premium.” The offer price may be a cash price (like $30 a share), or it could be a stock deal (where one share of the target stock is exchanged for some number of the acquirer’s shares). Usually, the target company’s stock price remains slightly below the acquisition price. The discount to the offer price reflects the market’s uncertainty about how likely the deal is to go through. The greater the risks to the deal closing, the wider this discount to the offer price.

As a result, most deals will trade at a spread. This means an investor can buy stock in the target company and expect to get paid the deal price if the deal goes through. As a general rule, mergers trade at a discount to the deal and there’s a spread than can be captured. So risk arbitrage is the investment strategy of buying the target company, holding it until the deal closes, and capturing the spread.

When a company announces its intention to purchase another, the stock price of the acquirer typically declines and the stock price of the target typically rises—but usually not fully to the offer price. There are cases of hostile bidding or very high synergies where outcomes can differ, but they’re exceptions to the norm. We’ll discuss them in a later series.

History and significance of merger arbitrage

Merger arbitrage is one of the classic “market-neutral” hedge fund strategies that has existed since hedge funds proliferated in the 1990s. However, the activity goes back even further. In fact, Benjamin Graham (of Graham and Dodd fame) discussed the activity in his 1949 book The Intelligent Investor, which is considered the bible of value investing.

Merger arbitrage funds proliferated in the 1990s and have been considered a subset of “event-driven” investing. “Event-driven investing” means there’s some catalyst to unlock value. In other words, the hedge fund manager is buying the stock not because it’s cheap, but because there’s some catalyst (a merger, a spinoff, a bankruptcy, or an activist investor) that will help the investment reach fair value. It’s a classic market-neutral strategy in that a stock for stock merger will be hedged with the acquirer’s stock, so if the market declines, the position will still make money.

Current deals

Right now, the biggest deals on Wall Street are between Time Warner (TWC) and Comcast (CMCSA) and between DirectTV (DTV) and AT&T (T). Investors who want to invest in M&A deals via an ETF should look at the IndexIQ ETF (MNA).

For access to premium risk arbitrage content, please email singh@marketrealist.com.