Regency’s PVR Midstream acquisition means Marcellus Shale exposure

Regency recently acquired a foothold in the Marcellus by buying PVR Partners LP in March this year in a deal worth $5.6 billion, specifically to boost its footprint in the Appalachian Basin.

Nov. 26 2019, Updated 1:41 p.m. ET

Regency Energy Partners LP

Regency Energy Partners LP (RGP) is engaged in the gathering and processing, compression, treating, and transportation of natural gas and the transportation, fractionation, and storage of natural gas liquids (NGLs).

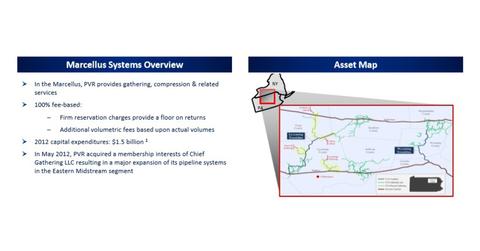

Regency recently acquired a foothold in the Marcellus by buying PVR Partners LP in March this year in a deal worth $5.6 billion, specifically to boost its footprint in the Appalachian Basin, which includes the Marcellus Shale. The recently closed acquisition of PVR Partners’ assets will come online and contribute to earnings and volume growth this year.

The PVR assets include a network of natural gas midstream pipelines and processing plants located principally in two prolific producing areas—the Marcellus and Utica shales in Appalachia and the Granite Wash in the Mid-Continent region—as well as coal and natural resource properties located in the Appalachian, Illinois, and San Juan basins

The primary selling point of PVR was likely its exposure to the Marcellus Shale, which is widely considered the premiere natural gas asset in the U.S., and which was a key component missing from Regency’s portfolio.

The combination creates a fully integrated midstream partnership platform by further expanding Regency’s position in the Appalachia Basin. This acquisition is expected to allow Regency to benefit from increased scale, enhanced geographic diversification, and a growing fee-based asset portfolio while delivering additional appealing service options to customers. Plus, the high level of producer activity around the Marcellus positions Regency to capture additional upside from organic growth opportunities.

Projections for 2014

Regency’s cash flow profile will be even more levered to natural gas gathering and processing following the PVR acquisition, accounting for 57% of gross margin on a pro forma basis, versus 48% for Regency standalone. Also, 80% of PVR’s cash flows are fee-based, which will help moderate some of the commodity exposure Regency picked up from a previous acquisition.

Other Midstream companies that have recently gained exposure in the Marcellus Shale include Crestwood Midstream Partners (CMLP), Williams Partners (WPZ), and MarkWest Energy Partners (MWE). Note that WPZ, CMLP, MWE, and RGP are all a part of the Alerian MLP ETF (AMLP).

Continue to the following part of this series to find out about one more midstream name capitalizing on production growth in the Marcellus.