Chevron Corporation: A must-know brief overview

Chevron Corporation is currently trading at EV-to-2014E EBITDA of 5x, has an approximately $239 billion market cap, and ~$245 billion enterprise value.

May 3 2021, Updated 11:22 a.m. ET

Chevron Corporation

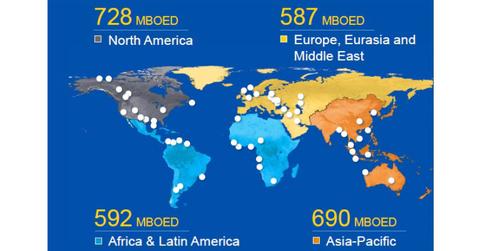

Chevron Corporation (CVX), headquartered in San Ramon, California, is an energy company engaged in exploration and production, refining, marketing, and transportation of oil and gas across more than 180 countries. It’s also involved in geothermal and chemical manufacturing and sales, as well as power generation. CVX’s operations are divided into two segments: Upstream and Downstream. The Upstream segment is involved in the exploration, development, and production of crude oil and natural gas.

The Downstream segment engages in refining crude oil into petroleum products, which are then marketed and transported through pipelines, marine vessels, motor equipment, rail cars, etc. Chevron also engages in transportation, storage, and marketing of natural gas.

Chevron’s upstream operations are based primarily in the U.S., Australia, Nigeria, Angola, Kazakhstan, and the Gulf of Mexico. Its downstream operations are based primarily in the West Coast of North America, the U.S. Gulf Coast, Southeast Asia, South Korea, Australia, and South Africa.

CVX is currently trading at EV-to-2014E EBITDA of 5x and has a market cap of ~$239 billion and an enterprise value of ~$245 billion. Select ETFs which hold CVX include Energy Select Sector SPDR Fund (XLE), Vanguard Energy ETF (VDE), SPDR S&P Oil & Gas Exploration & Production ETF (XOP), and iShares U.S. Energy ETF (IYE).

On May 2, Chevron Corporation (CVX) announced earnings for the first quarter 2014 ended March 31, 2014. This was followed by an earnings report released in March.

Read the following parts of the series to know how CVX performed in Q1 2014.