How does the Fed’s monetary policy affect the yield curve?

When it comes to changes in the shape of the yield curve, there is no bigger factor driving these changes than the Federal Reserve.

March 14 2014, Published 10:53 a.m. ET

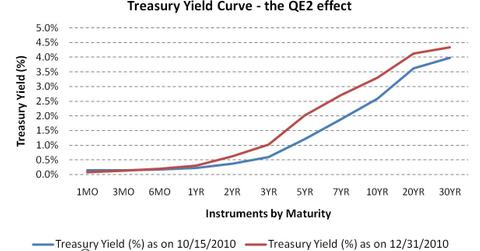

The chart below shows the effect of Fed’s second round of quantitative easing (or QE2, which started in November 2010) on the Treasury yield curve.The monetary policy of a country is the process by which the central monetary authority, like the Federal Reserve in case of U.S., controls the supply of money in the economy. This is primarily done by targeting a particular interest rate for achieving economic growth and stability, controlling inflation, reducing unemployment, etc.

A monetary policy can be expansionary or contractionary.

An expansionary policy increases the total supply of money in the economy more rapidly than usual. Such measures are usually used to combat unemployment in a recession by lowering interest rates in the hope that easy credit will entice businesses into expanding.

A contractionary policy expands the money supply more slowly than usual or even shrinks it. Such a measure is intended to slow inflation in order to avoid the resulting distortions and deterioration of asset values.

It is important to note that a monetary policy differs from a fiscal policy, which refers to taxation, government spending, and associated borrowing.

It is the monetary policy that influences the slope of the yield curve. A tightening of the monetary policy usually means a rise in short-term interest rates, typically intended to lead to a reduction in inflationary pressures. When those pressures subside, it is expected that a policy easing, that is lower rates, will follow. Whereas short-term interest rates are relatively high as a result of the tightening, long-term rates tend to reflect longer term expectations and rise by less than short-term rates. The monetary tightening both slows down the economy and flattens (or even inverts) the yield curve.

The effect of a monetary tightening, which leads to rise in short-term rates, is also reflected in the performance of short-term Treasury ETFs, such as the iShares Barclays 1-3 Year Treasury Bond Fund (SHY) and the Schwab Short-Term U.S. Treasury ETF (SCHO). In a rising rate environment, certain investors prefer ETFs that are designed to play rising interest rates, such as the SPDR Barclays Capital Investment Grade Floating Rate ETF (FLRN), which tracks floating rate debt of companies like Goldman Sachs (GS) and JPMorgan Chase & Co. (JPM).

When it comes to changes in the shape of the yield curve, there is no bigger factor driving these changes than the Federal Reserve. However, the actions of the Federal Reserve affect short-term interest rates differently compared to long-term interest rates. To know how, continue to the next part of this series.