SPDR Bloomberg Barclays Investment Grade Floating Rate ETF

Latest SPDR Bloomberg Barclays Investment Grade Floating Rate ETF News and Updates

Industrials March manufacturing releases are critical in assessing a recovery

The Purchasing Managers Manufacturing Index (or PMI) is based on a monthly survey of selected companies that provide an advanced indication of what’s really happening in the private-sector economy.

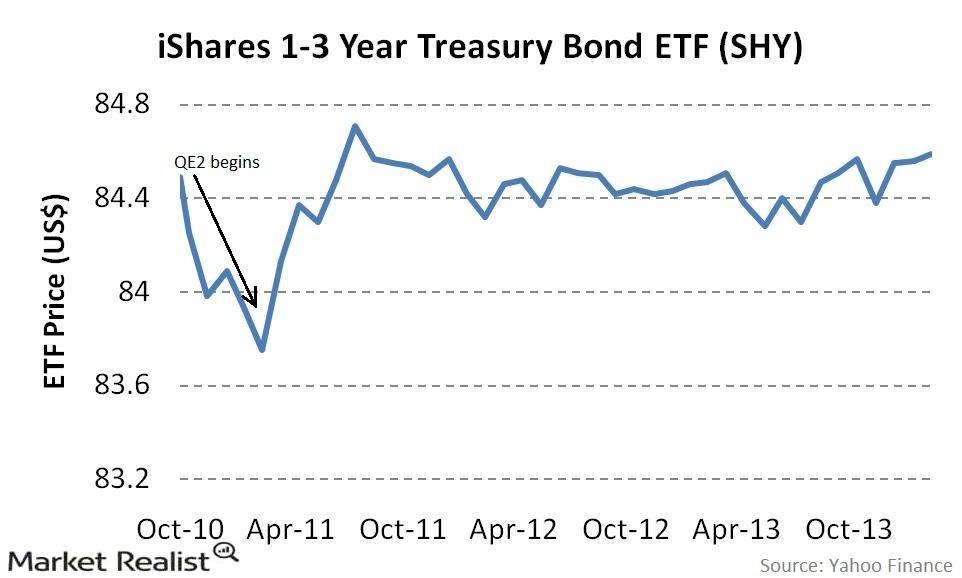

Must know: How the Fed’s monetary policy affects short-term yields

The Fed directly influences the short-term yields by either buying or selling short-term Treasuries or affecting the Fed funds rate.

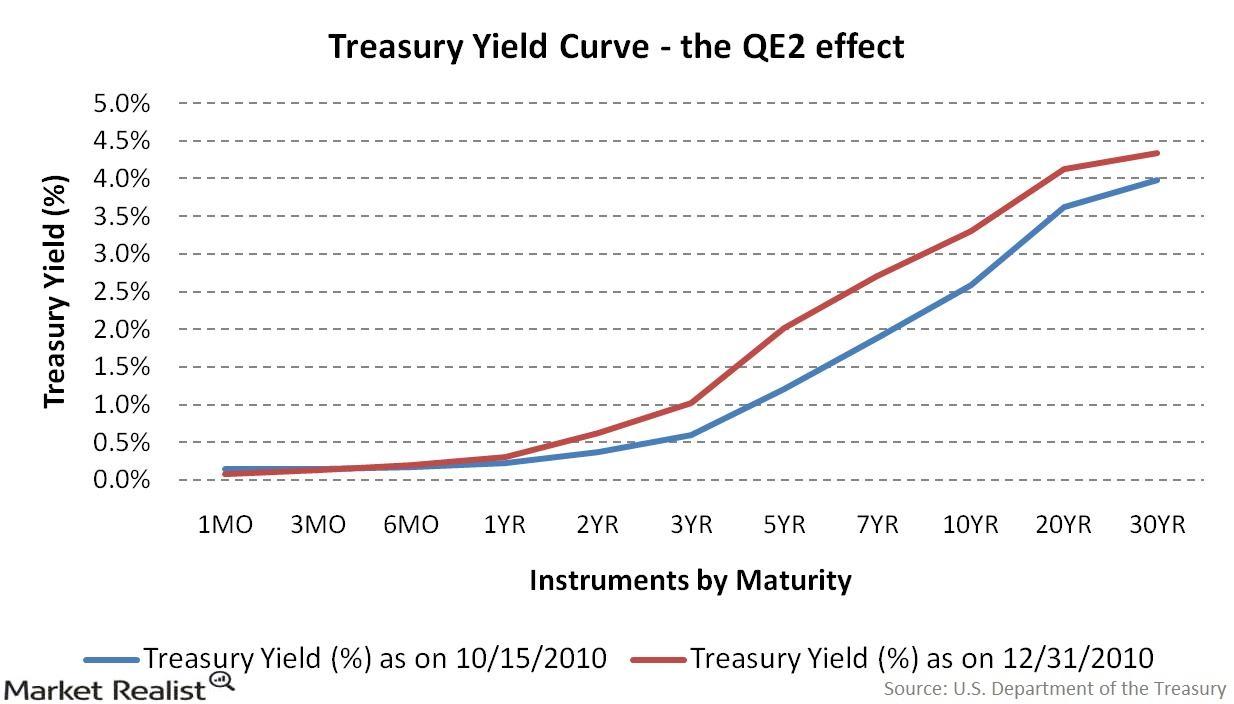

How does the Fed’s monetary policy affect the yield curve?

When it comes to changes in the shape of the yield curve, there is no bigger factor driving these changes than the Federal Reserve.