Alken Says $19 Billion Price for SanDisk Is Too High

Alken stated that in light of changing market dynamics and the capital market scenario, the $19 billion price for SanDisk, which has been posting declining earnings in fiscal 2015, is too high.

Feb. 25 2016, Updated 6:07 p.m. ET

Alken hits on the $19 billion price tag for SanDisk

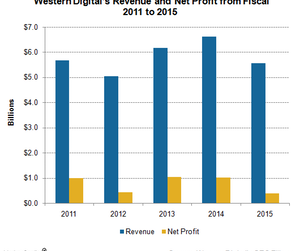

In the previous article, we saw that Alken Asset Management, a top Western Digital (WDC) shareholder, released a public letter asking other shareholders to vote against the SanDisk (SNDK) merger. The investor stated that in light of changing market dynamics and the capital market scenario, the $19 billion price for SanDisk, which has been posting declining earnings in fiscal 2015, is too high. Let’s look now at the financial health and future growth prospects of SanDisk.

SanDisk’s financial performance

Fiscal 2015 has been a bad year for SanDisk. Its revenue and net profits were lower than 2014, 2013, and 2011. The ASP (average selling price) of SSDs (solid-state drives) is falling faster due to a slowing demand and growing competition. The ASP fell 34% in 2015 compared to 22% in 2014, thus affecting profit margins.

Competitors Samsung (SSNLF) and Micron Technology (MU) also posted declining revenues in 2015. That indicated demand weakness in the industry due to slowing sales of PCs (personal computers) and smartphones. SanDisk’s key customer, Apple (AAPL), scaled back its iPhone production in the December 2015 quarter due to slow demand, especially in China (FXI).

SanDisk’s free cash flow has declined by 60% YoY (year-over-year) in fiscal 2015, as its capital expenditure more than doubled. Despite this, the company’s total cash reserve stood at $1.5 billion, an 82.8% rise YoY. Its total debt was $1.2 billion at the end of fiscal 2015.

Company guidance

SanDisk’s fiscal 2015 wasn’t strong, and the outlook for 2016 is also bleak. For fiscal 1Q16, SanDisk expects its revenue and gross margin to fall below the fiscal 4Q15 level. It expects revenue to be $1.2–$1.3 billion, lower than fiscal 4Q15 revenue of $1.5 billion. It expects gross margin to be 39%–42%, lower than the fiscal 4Q15 margin of 43%.

SanDisk earned record yields from 15-nanometer 2D NAND (negative-AND) in fiscal 2015, but this is unlikely to sustain as the industry transitions to 3D NAND. The company is also ramping up 3D NAND production, but so are Intel and Micron. Samsung (SSNLF) has already started volume production of 3D NAND.

Looking at the financial figures, it looks like Western Digital is acquiring a company that’s struggling with declining revenue, pricing, and margins as well as higher R&D (research and development) costs.

In the next part of the series, we’ll see why Western Digital’s top shareholder is unhappy about the SanDisk merger and why the deal may not happen.