Why industry capacity changes also affect urea prices and profits

Generally, a capacity increase tends to lag demand growth, as producers like to see a stronger market before making significant investments.

Dec. 4 2020, Updated 10:52 a.m. ET

Capacity and marginal producers

As we said earlier, changes in capacity to produce nitrogenous fertilizers can also affect marginal producers and prices of urea. Capacity often increases due to attractive profit prospects. But an entry by another player or expansion from an existing one influences prices and profits of companies like CF Industries Holdings Inc. (CF), Potash Corp. (POT), Terra Nitrogen Company LP (TNH), and Agrium Inc.’s (AGU) nitrogenous business.

Changes in cost of feed stocks

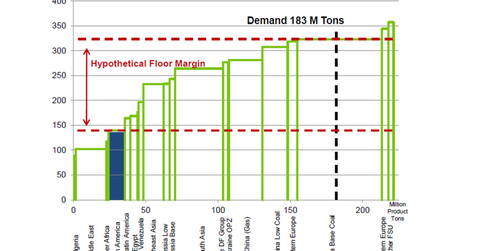

Let’s take a look at the world production cost curve in 2013. Earlier this year, CF Industries Holdings Inc. (CF) showed that China’s base coal producers were the marginal cost producer, which has production capacity of approximately 60 million product tons. Notice that if China’s base coal producers had lower feed stock costs, their positions on the curve would shift to the left. If product costs fall below Western European producers, China may well be the cheaper supplier. This is a more visual representation of how changes in the cost of feed stocks affect marginal cost producers.

Changes in capacity

But now, let’s picture a case where capacity starts to expand in North America due to attractive input costs. Based on the chart above, North America currently produces a limited amount of urea of about 15 million short tons. This is rather small, considering that the United States is one of the largest agricultural producers in the world, which makes it a net importer of urea.

Suppose over the next few years, approximately 100 million product tons of capacity will be added in North America. If every other factor stays constant, including demand, the increased capacity will push more expensive producers out of the industry. Producers in China and Western Europe would be out of business and prices of urea would fall to the new marginal producer.

General comment

This concept applies to many other commodity producers and is something to look out for. Generally, a capacity increase tends to lag demand growth, as producers like to see a stronger market before making significant investments. A lengthy development period is another factor that limits the possibility of overexpansion. Yet, investors should be wary when demand isn’t growing as fast as first expected or when capacity growth exceeds demand growth.