What’s the Outlook for American International Group?

American International Group’s dividend per share rose 58% in 2016 and was flat in 2017.

Jan. 11 2018, Published 3:11 p.m. ET

What led to American International Group’s revenue fall

In this series, we’ll discuss American International Group (AIG), Delta Air Lines, Corning, Tyson Foods, Assurant, and Gilead Sciences.

American International Group’s revenue fell 10% and 6% in 2016 and 9M17 (the first nine months of 2017), respectively. Premiums, policy fees, net realized capital losses, and other income drove the decline in 2016 offset by net investment income. US, Europe, and Japan recorded declines in 2016, which were offset by other regions. Total consolidated operating revenue fell 6% and 5% in 2016 and 9M17, respectively. Premiums and net realized capital losses drove the decline in 9M17 offset by policy fees, net investment income, and other income.

How much did the EPS fall?

Benefits, losses, and expenses decreased 5% in 2016 due to lower operating expenses and gains on asset sales. They increased by 1% in 9M17 despite lower operating expenses. As a result, income from continuing operations decreased 102% and 83% in 2016 and 9M17, respectively. Adjusted income from continuing operations decreased 34% and 32% in 2016 and 9M17, respectively.

Adjusted net income fell 86% and 47% in 2016 and 9M17, respectively. Adjusted diluted EPS fell 84% and 42% in 2016 and 9M17, respectively. Share buybacks have enhanced the EPS numbers.

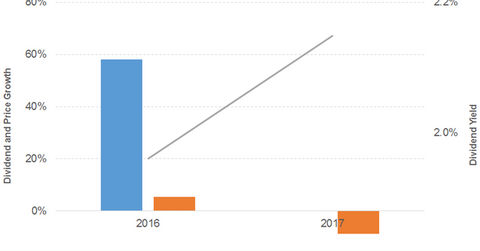

Dividend and price growth

Dividend per share grew 58% in 2016 and remained flat in 2017. Prices gained 5% in 2016 before losing 6% in 2017. This led to the upward rising slope of the dividend yield curve. A forward PE of 22.1x and a dividend yield of 2.2% compares to a sector average forward PE of 19.1x and a dividend yield of 1.9%.

How does it compare to the broad indexes?

The S&P 500 (SPX-INDEX) (SPY) has a dividend yield of 2.2%, a PE ratio of 23.4x, and a YTD return of 19.6%. The Dow Jones Industrial Average (DJIA-INDEX) (DIA) has a dividend yield of 2.2%, a PE ratio of 22.3x, and a YTD return of 25.1%. The NASDAQ Composite (COMP-INDEX) (ONEQ) has a PE ratio of 28.2x and a YTD return of 24.8%.

What is the outlook for operating revenue and EPS?

Total consolidated operating revenue is projected to record a fall of 8% and 4% for 2017 and 2018, respectively. The 2017 and 2018 diluted EPS is expected to grow 639% and 94%, respectively.