How FedEx’s Performance Influenced Its Outlook

FedEx’s (FDX) revenue grew 6% and 20% in 2016 and 2017, respectively. The FedEx Ground, FedEx Freight, and FedEx Services segments drove the 2016 growth, offset by the FedEx Express segment.

Jan. 11 2018, Updated 10:33 a.m. ET

What drove revenue growth

FedEx’s (FDX) revenue grew 6% and 20% in 2016 and 2017, respectively. The FedEx Ground, FedEx Freight, and FedEx Services segments drove the 2016 growth, offset by the FedEx Express segment. Every segment mentioned above, along with the TNT Express segment, drove growth in 2017. The United States noted growth in every segment in both years. FedEx Express and FedEx Freight in international regions saw some declines in 2016 before growing in 2017. The FedEx Services segment, after some declines in 2016, maintained a flat growth rate in 2017.

Every segment drove a 7% growth rate in 6M18. The TNT Express segment became part of the FedEx Express segment.

Gross profit grew 8%, 16%, and 5% in 2016, 2017, and 6M18, respectively. Operating expenses rose 8%, 16% and 6% in 2016, 2017, and 6M18, respectively. Salaries and employee benefits, depreciation and amortization, and other expenses drove overall expenses higher. 2015 and 2016 were also affected by retirement plan adjustments. As a result, operating income grew 65% and 64% in 2016 and 2017, respectively, before falling 2% in 6M18. Adjusted operating income grew 18%, 9%, and 1% in 2016, 2017, and 6M18, respectively.

Interest expenses increased between 2015 and 2017. However, they remained relatively flat in 6M18. Therefore, adjusted net income grew 17%, 10%, and 1% in 2016, 2017, and 6M18, respectively. Adjusted diluted EPS (earnings per share) grew 21% and 14% in 2016 and 2017, respectively. They remained flat in 6M18.

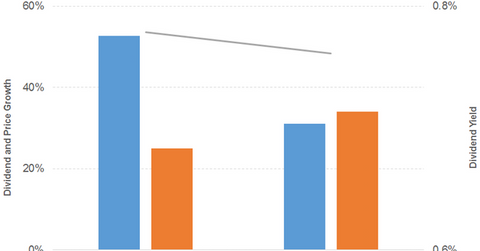

Dividend and price growth

The company’s dividend per share grew 53% and 31% in 2016 and 2017, respectively. Prices rose 25% and 34% in 2016 and 2017, respectively. As a result, the downward dividend yield curve had a flat slope. A forward PE of 19.2x and dividend yield of 0.8% compares to a sector average forward PE of 22.7x and a dividend yield of 1.5%.

Compare to the broad indexes

The S&P 500 (SPX-INDEX)(SPY) offers a dividend yield of 2.2%, a PE ratio of 23.4x, and a YTD (year-to-date) return of 19.6%. The Dow Jones Industrial Average (DJIA-INDEX)(DIA) has a dividend yield of 2.2%, a PE ratio of 22.3x, and a YTD return of 25.1%. The NASDAQ Composite (COMP-INDEX)(ONEQ) has a PE ratio of 28.2x and a YTD return of 24.8%.

Revenue and EPS outlook

FedEx is projected to grow its revenue 7% and 5% in 2017 and 2018, respectively. The 2017 and 2018 diluted EPS is projected to grow 6% and 21%, respectively.