How Was 2017 for European Markets?

At the start of 2017, elections in many European countries brought some political uncertainty to the European markets.

Nov. 20 2020, Updated 3:05 p.m. ET

How was 2017 for Europe?

At the start of 2017, elections in many European countries brought some political uncertainty to the European markets. Investors feared that rising political uncertainty could weaken European asset prices and ultimately challenge global markets.

The euro (FXE) fluctuated at the beginning of the year due to the uncertainty of election results in the Netherlands, Germany, and France. State Street Global Advisors predicted that the euro would bounce back in the second half of 2017 if European Union-friendly parties won and the European Central Bank considered quantitative easing. That is precisely what happened. European markets bounced back after the elections and so did the euro with a rise of 11.7% YTD.

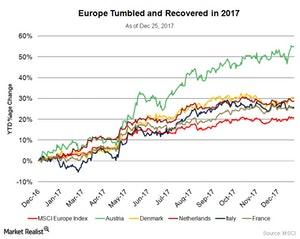

The MSCI Europe Index (IEV), which covers large-cap and mid-cap companies across 15 developed markets in Europe, had a staggering growth of ~21% YTD in 2017. All the developed countries in Europe that are part of this index enjoyed tremendous growth in 2017.

Who were the winners in Europe in 2017?

Tthe best-performing European markets were Austria (EWO) with a gain of 54.8%, Denmark (EDEN) with a gain of 30.5%, the Netherlands (EWN) with an increase of 28.6%, Italy with a gain of 25.6%, and France (EWQ) with a gain of 25.2%.

The Wiener Borse AG reported that better domestic demand and healthy economic activity in the neighboring countries like the Czech Republic, Slovakia, Hungary, and Germany had been the driving factor in Austria’s growth acceleration this year. According to the Organization for Economic Co-operation and Development (or OECD), the real GDP growth rate for Austria is expected to be around 2.9% in 2017 and 2.4% for 2018.

Though Denmark’s economy struggled in 3Q17, it is expected to bounce back in 4Q17 and end the year on a strong note. A Reuters report on December 8 stated that Denmark’s center-right minority government has managed to secure support for 2018’s budget from its populist ally, the Danish People’s Party (or DPP). According to OECD’s forecast, the country’s real GDP will be 2.1% for 2017 and 1.9% for 2018.

Italy’s (EWI) economic recovery accelerated in 2017 driven by domestic demand and consumer spending led by tax cuts for low earners. Fitch Ratings mentioned in a report in November that the national election in 2018 likely won’t result in a government dedicated to euro-skeptic policies.

Like other European countries, France (EWQ) is on the path of economic recovery as well. According to OECD data, the real GDP growth rate for France is expected to be around 1.81% for 2017 and 1.80% for 2018.

Winners in the emerging markets in Europe

Among the emerging markets in Europe, Poland (EPOL) was another rising star in 2017. The MSCI Poland Index gained 48.3% despite the country’s ruling Law & Justice Party facing criticism from the European Union. According to OECD forecast, the country’s real GDP for 2017 is expected to be 4.3% for 2017 and 3.5% for 2018.

Other emerging markets in Europe that caught investors’ attention were Hungary with a gain of 33%, Greece (GREK) with a gain of 26.1%, and the Czech Republic with a gain of ~26% YTD in 2017.

Let’s move on to discuss Asia’s performance in 2017.