What Rising Services Activity Means for the US Economy

After reaching a lifetime high in October 2017, the ISM (Institute of Supply Management) non-manufacturing index fell 2.7 percentage points to 57.4%.

Dec. 22 2017, Published 1:41 p.m. ET

ISM non-manufacturing index fell in November

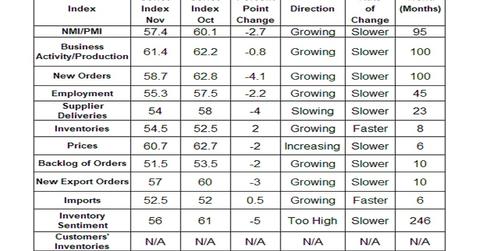

After reaching a lifetime high in October 2017, the ISM (Institute of Supply Management) non-manufacturing index fell 2.7 percentage points to 57.4% compared to the October 2017 reading of 60.1. ISM releases a monthly report on economic activity in the non-manufacturing sector, or the services (IYC) sector. Only two of the 18 industries surveyed reported contraction in November, and all the indicators stayed in expansionary territory. Economic activity in the services sector expanded for the 95th consecutive month. Below is a list of all other economic activity indexes for the services sector, as reported by ISM.

Which industry’s activity declined in November?

The two industries that reported contraction in November were agriculture (DBA) and forestry (WOOD), fishing, and hunting. But looking at the performance of the sector over the past year, all indicators of economic activity for the sector remain in expansionary territory. The forward-looking indicator for new orders is 58.7. Although that’s lower than the October reading of 62.8, it still signals a possible healthy future for the sector.

The industries that stood out in the December report include management services, retail trade (RTH), and wholesale trade (COST). These industries expect further growth in demand, according to the survey reports.

Outlook for the services sector

Economic activity in the services sector is expected to remain in expansionary territory in 2018. All forward-looking indicators point to further growth. Add to that the impact of the tax reform bill that was passed this week, and the sector could witness continued growth in 2018.

In the next part of this series, we’ll analyze the trends in the trade balance of the US economy.