Invesco DB Agriculture Fund

Latest Invesco DB Agriculture Fund News and Updates

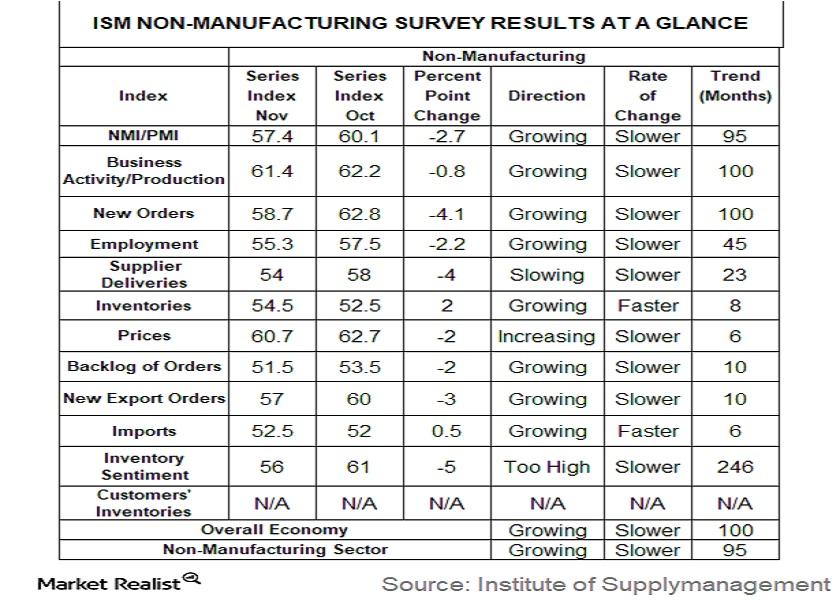

What Rising Services Activity Means for the US Economy

After reaching a lifetime high in October 2017, the ISM (Institute of Supply Management) non-manufacturing index fell 2.7 percentage points to 57.4%.

Can Green Bonds Provide a Potential Hedge against Climate Risk?

In this environment, green bonds could offer investors an option to hedge their portfolios against climate-related risk and enjoy a good risk-return profile.

AGCO Acquires Cimbria, Expands in Seed and Grain Handling

On June 29, AGCO (AGCO) announced that it acquired Cimbria Holdings from Silverfleet Capital for 310 million euros ($340 million).

How Deere’s Margins Differ across Key Geographical Markets

The US and Canada regions were responsible for 63.9%, 63%, and 66.1% of Deere & Company’s (DE) total revenues in 2013, 2014, and 2015, respectively.

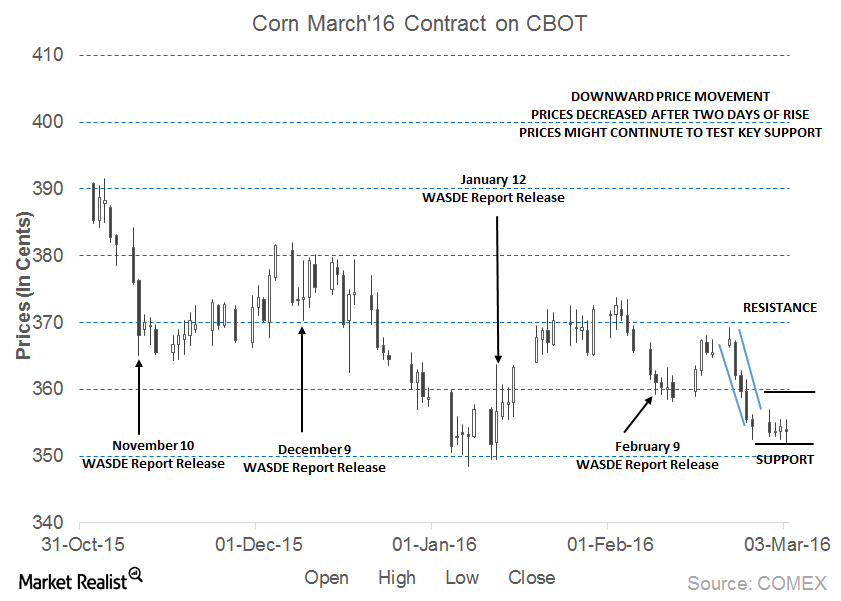

Corn Prices Could Continue to Test Crucial Support

March 2016 corn futures prices were trading near the support level of 355 cents per bushel on March 3, 2016. Prices declined after two days of rising by 0.28%.

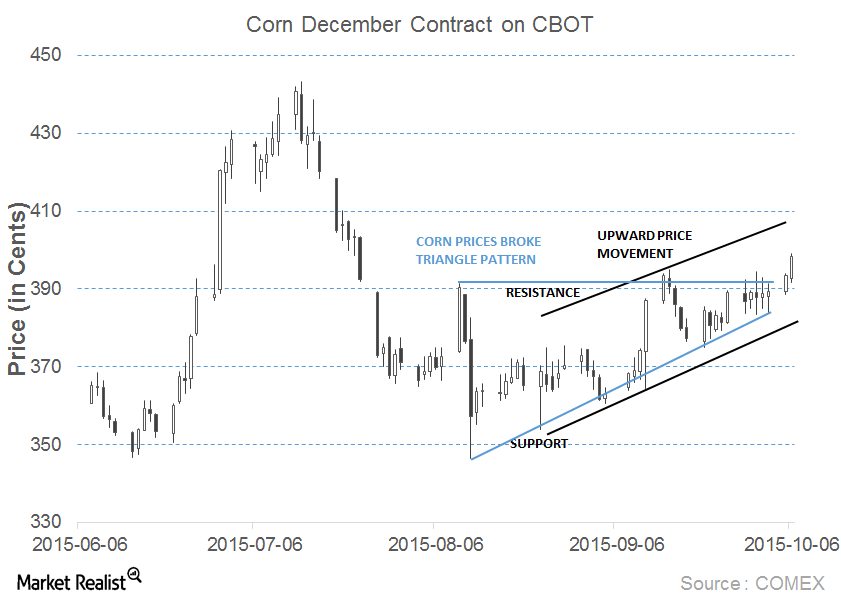

Will Corn Prices Be Range-Bound before WASDE Report Release?

On October 6, 2015, CBOT (Chicago Board of Trade) December expiry of corn futures contracts rose, breaking the resistance level.