Why the Euro Continued to Fall Last Week

The euro-dollar (FXE) closed the week ending December 8 at 1.18, depreciating by 1.1% against the US dollar (UUP).

Dec. 11 2017, Updated 9:04 a.m. ET

German political stalemate and strong dollar drag euro lower

The euro-dollar (FXE) closed the week ending December 8 at 1.18, depreciating by 1.1% against the US dollar (UUP). The political impasse in Germany continued to take its toll on the shared currency, as there was no significant progress in forming a coalition government. The other factor that has driven the euro lower was the strength of the US dollar, which appreciated on the back of tax reforms and positive economic data in the US.

European equity markets (VGK) have recovered from the losses of the previous week, shrugging off the political uncertainty in the EU. The German DAX (DAX) ended the week 2.3% higher, the Euro Stoxx (FEZ) was up by 1.9%, and France’s CAC appreciated by 1.6% in the previous week.

Euro speculators increase bullish bets

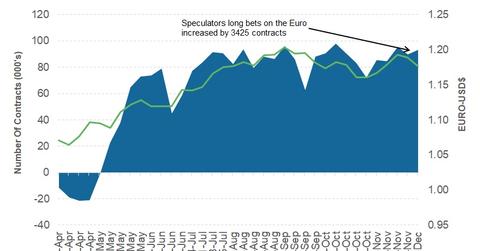

As per the latest commitment of traders (or COT) report, released on December 8 by the Chicago Futures Trading Commission (or CFTC), speculator positions increased by 3,425 contracts last week. The total net speculative bullish positions on the euro (EUFX) increased from 89,681 contracts to 93,106 contracts last week.

Outlook for euro

The European Central Bank is scheduled to meet on Thursday, and there are no changes expected to policy after the extension of its quantitative easing program in October. There is a possibility of the ECB upgrading its projections as economic activity indicators improved in the last two quarters. Other economic data releases during the week include purchasing managers’ indexes, which are expected to improve. Overall, the euro is likely to be impacted by the US dollar demand this week rather than any domestic news.

In the next part of this series, we will discuss how new Brexit developments impacted the British pound last week.