What Could Drive Arch Coal Stock in 2017?

Although the majority of coal (KOL) stocks began 2016 on a weak note, they outperformed the broader market in 2016.

Nov. 20 2020, Updated 5:06 p.m. ET

Series overview

Arch Coal (ARCH) will announce its 4Q16 earnings results on February 8, 2017, during market hours. In this series, we’ll look at analyst expectations for Arch Coal’s 4Q16 earnings and factors that led analysts to arrive at those expectations.

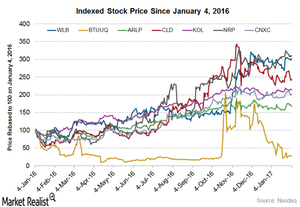

Arch Coal’s stock performance

Although the majority of coal (KOL) stocks began 2016 on a weak note, they outperformed the broader market in 2016. Much of those gains were seen in the second half of 2016. OPEC’s (Organization of the Petroleum Exporting Countries) crude oil production curtailment deal followed by its historic production curtailment agreement with non-OPEC oil producers boosted commodity prices in 2H16. Moreover, Donald Trump’s US presidential victory helped coal stocks to retain their gains and their momentum in 4Q16.

Meanwhile, Arch Coal successfully completed its financial restructuring and emerged from Chapter 11 bankruptcy protection on October 5, 2016. Since then, ARCH stock has risen nearly 14% through February 3, 2017.

Peers Alliance Resource Partners (ARLP) and Natural Resource Partners (NRP) rose nearly 4% and 21%, respectively, during the same period. However, Cloud Peak Energy (CLD) remained nearly flat. The VanEck Vectors Coal ETF (KOL), which tracks the overall performance of major coal mining companies around the world, rose nearly 9%.

Driving factors in 2017

According to the EIA’s (U.S. Energy Information Administration) latest short-term energy outlook, coal is expected to surpass natural gas’s share in electricity generation this winter, which could have a positive impact on the company’s revenue in 1Q17. Moving ahead, natural gas prices and seaborne thermal and metallurgical coal prices could influence the company’s domestic and export sales volume.

In the long term, the fate of the Clean Power Plan and other environment regulations under a Trump presidency could determine the future of major coal mining companies in the US.

Next, let’s see how analysts are rating Arch Coal.