Why the Euro Is Likely to Remain Quiet this Week

The euro-dollar pair (FXE) closed the week ending November 3 at 1.1609 against the US dollar (UUP). Worries about a possible escalation of tensions in Spain’s Catalonia region proved futile.

Nov. 7 2017, Updated 7:33 a.m. ET

The euro remained unchanged last week

The euro-dollar pair (FXE) closed the week ending November 3 at 1.1609 against the US dollar (UUP). Worries about a possible escalation of tensions in Spain’s Catalonia region proved futile. European markets were dominated by strong corporate earnings and stronger-than-expected economic data. With the ECB (European Central Bank) clearing the air about future rate hikes, it may stay put until September 2018, reducing demand for the shared currency.

European equity markets (VGK) gained momentum after the ECB confirmed no rate hike for almost a year. The German DAX (DAX) ended the week 1.98% higher, Euro Stoxx (FEZ) was up 1.03%, and France’s CAC was up 0.43% the previous week.

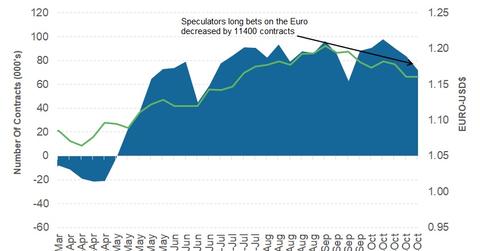

Euro speculators decrease their bets

As per the latest “Commitment of Traders” (or COT) report released on Friday, November 3, by the Chicago Futures Trading Commission (or CFTC), speculators reduced their bullish positions on the euro for a third week in a row. Total net speculative bullish positions on the euro (EUFX) fell by 11,400 contracts from 83,504 to 72,097 on October 31. Euro traders are likely to remain on the fence, as there’s no domestic source of uncertainty in the near term.

Outlook for the euro

The European currency is likely to remain range-bound this week. Economic data is limited, with investor confidence being the only noteworthy release. Going forward, demand for the US dollar could be the key driver for the euro, assuming that the Catalonian independence referendum has been brushed under the rug.

In the next part of this series, we’ll discuss why the British pound fell after the interest rate hike from the Bank of England.