Did Occidental Petroleum Generate Positive Free Cash Flow in 3Q17?

On a year-over-year basis, OXY’s 3Q17 operating cash flow was ~65% higher than the ~$650 million it generated in 3Q16.

Nov. 7 2017, Updated 7:31 a.m. ET

Occidental Petroleum’s operating cash flows

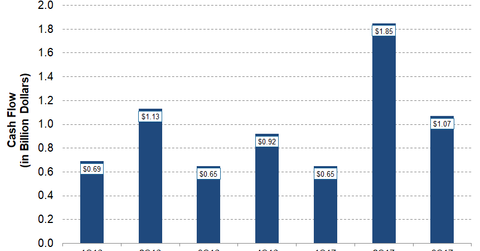

For 3Q17, Occidental Petroleum (OXY) reported operating cash flows of ~$1.07 billion, which was ~6.0% lower than Wall Street analysts’ expectations for ~$1.13 billion in cash flows. On a year-over-year basis, OXY’s 3Q17 operating cash flows totaled ~65.0% higher than the ~$650.0 million it generated in 3Q16.

According to OXY’s 3Q17 press release, its Chemical business contributed ~$425.0 million to its cash flows in 3Q17.

Occidental Petroleum’s cash flow trend

Occidental Petroleum’s (OXY) cash flows dropped steeply in 1Q15, mainly due to lower realized crude oil (SCO) and natural gas (BOIL) prices. In 1Q15, Occidental Petroleum reported its lowest cash flows since 2004—$561.0 million.

In 2015 and 2016, Occidental Petroleum reported much lower cash flows than in the preceding years. In 2Q17, OXY reported its highest cash flows since 1Q15. OXY’s peer ConocoPhillips (COP) reported ~$1.1 billion in cash flows in 3Q17.

In 3Q17, Occidental Petroleum spent ~$1.6 billion in capital expenditures. As a result, its free cash flows totaled ~-$560.0 million.

Capex

In 3Q17, Occidental Petroleum’s capital expenditures (or capex) totaled ~$1.6 billion, which was ~136.0% higher than its capital expenditures of $690.0 million in 3Q16. OXY’s capital expenditure was higher due to the ~$683.0 million spent on asset purchases. Excluding the asset purchases, OXY spent ~$947.0 million on its business segments.

Out of this, OXY spent $439.0 million on Permian Resources, $100.0 million on Permian EOR (enhanced oil recovery), $143.0 million on its Middle East operations, $63.0 million on its Chemical business, and $68.0 million on its Midstream and Marketing business.

For 2017, Occidental Petroleum expects higher capital expenditure of $3.0 billion–$3.6 billion. OXY’s 2017 capital expenditure guidance is much higher than OXY’s fiscal 2016 capital expenditures of $2.9 billion.

OXY plans to devote the majority of its 2017 capital budget to oil and gas development, with Permian Resources receiving largest increase in capital.

OXY’s peer Encana (ECA) expects its 2017 capital expenditures to be $1.6 billion–$1.8 billion, which represents a midpoint increase of ~55.0% over its capex of ~$1.1 billion in 2016. Like OXY, ECA is increasing its focus on unconventional assets in the US.