How Euro Managed to Bounce Back Last Week

The euro-dollar (FXE) pair closed the week ending November 10 at 1.2, appreciating 0.48% against the US dollar (UUP).

Nov. 15 2017, Updated 10:31 a.m. ET

Euro appreciated 0.48% last week

The euro-dollar (FXE) pair closed the week ending November 10 at 1.2, appreciating 0.48% against the US dollar (UUP). The European currency managed to stop its slide and rebound against its trading partners after the US dollar rally stalled last week. Economic data including retail sales, trade balance, and European Union economic forecasts have all been positive for the euro, signaling a possible bottom for the shared currency.

European equity markets (VGK) along with the US markets closed lower in the previous week. The German DAX (DAX) ended the week lower by 2.6%, the Euro Stoxx (FEZ) was down 2.6%, and France’s CAC was down 2.5% in the previous week. The weaker opening could mean further losses for these indexes this week too.

Euro speculators decrease their bets

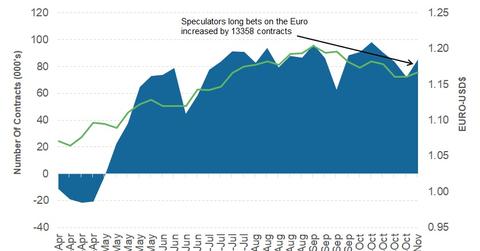

As per the latest Commitment of Traders report, released on Friday, November 13 by the Chicago Futures Trading Commission, speculators rushed back into long positions on the euro after three weeks of declines. The total net speculative bullish positions on the euro (EUFX) rose by 13,000 contracts from 72,097 contracts to 85,455 contracts as of November 7. The stalling US dollar rally and euro speculative bets bouncing back could mean that the euro has found a short-term floor.

Outlook for euro

Last week’s strength in the euro is likely to remain unchallenged for lack of any market-moving data this week. The US tax reform uncertainty could have been priced in already and further developments aren’t likely to be announced this week. In the Euro area, German Q3 GDP and purchasing manager index data are scheduled to be released and are expected to improve from the previous readings. With the US dollar rally stalling, the euro could be poised for further gains this week.

In the next part of this series, we’ll discuss how renewed Brexit worries and politics dragged the British pound lower.