Behind Novartis’s Respiratory Drug Performance in 3Q17

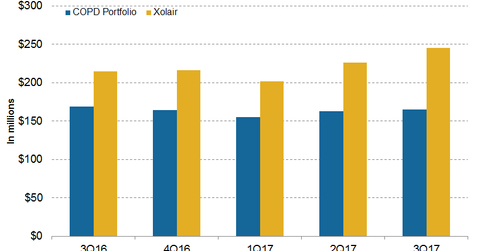

In 3Q17, Novartis’s COPD (Chronic Obstructive Pulmonary Disorder) portfolio reported revenues of $165 million, which with ~2% higher YoY and 1% higher QoQ.

Nov. 15 2017, Updated 9:01 a.m. ET

COPD Portfolio revenue trends

In 3Q17, Novartis’s (NVS) COPD (Chronic Obstructive Pulmonary Disorder) portfolio reported revenues of $165 million, which was ~2% higher YoY (year-over-year) and 1% higher QoQ (quarter-over-quarter). Novartis’s COPD portfolio includes the Ultibro breezhaler, the Seebri breezhaler, and the Onbrez breezhaler.

In 3Q17, the Ultibro breezhaler generated revenues of ~$101 million, which was ~6% higher YoY and 2% higher QoQ. The Seebri breezhaler generated revenues of $37 million, which was ~3% higher QoQ. The Seebri breezhaler’s YoY revenue growth remained flat.

Xolair revenue trends

In 3Q17, Xolair reported revenues of $245 million, which was ~14% higher YoY and 8% higher QoQ. Xolair finds its use in the treatment of moderate to severe persistent asthma and chronic idiopathic urticaria.

In September 2017, Novartis announced that new data from its Optima trial demonstrated that nearly 90% of patients with chronic spontaneous urticaria (or CSU) responded well to primary Xolair therapy and regained symptom control within 12 weeks of treatment.

In the marketplace, Novartis’s Xolair competes with GlaxoSmithKline’s (GSK) Nucala (mepolizumab) and Teva Pharmaceuticals’ (TEVA) Cinqair (reslizumab).

Notably, the First Trust Value Line Dividend Index Fund (FVD) invests ~0.51% of its total portfolio holdings in Novartis. Johnson & Johnson (JNJ) makes up ~0.52% of FVD’s total portfolio holdings.