Why the British Pound Appreciated by 1.5% Last Week

The British Pound (FXB) appreciated by more than 2% against the US dollar last week. The pound (GBB) closed for the week at 1.3288, appreciating by 1.69% against the US dollar (UUP).

Oct. 17 2017, Updated 10:39 a.m. ET

The British pound appreciated against the US dollar

The British Pound (FXB) appreciated by more than 2% against the US dollar last week. The pound (GBB) closed for the week at 1.3288, appreciating by 1.69% against the US dollar (UUP). The pound gained strength from multiple sources last week. The possibility of a softer Brexit was inferred from comments by the European Union’s chief negotiator Michel Barnier, who suggested the possibility of a two-year transition phase, supporting the pound.

British equity markets (BWX) traded on a positive note last week, and the FTSE 100 index (EWU) posted a close of 7,535.00, up 0.17% for the week.

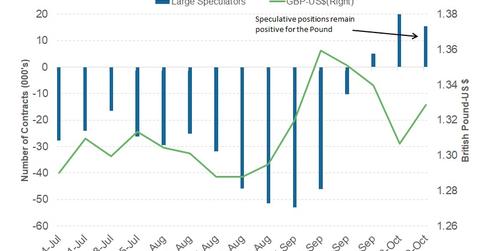

Speculators remain bullish

As per the latest “Commitment of Traders” (or COT) report released on October 13 by the Chicago Futures Trading Commission (or CFTC), speculators trimmed their bullish positions on the British pound. The total outstanding net positions were 15,508 long contracts, compared to 19,949 long contracts the week before. News about a softer Brexit wouldn’t have reflected completely in this week’s positioning, and we can expect an uptick in positioning next week.

Week ahead for the British Pound

Important economic data are scheduled to be reported from the United Kingdom this week. Reports on inflation, unemployment, and retail sales are due to be reported and likely to impact the odds of a rate hike from the Bank of England (or BOE). Key members of the BOE should soon be testifying before the UK Treasury committee, which could offer further insight about a rate hike next month. Hints of hawkishness could drive the pound higher in the week ahead.

In the next part of this series, we’ll see how the US dollar’s weakness benefitted the Japanese yen last week.