Why British Pound Speculators Turned Bullish after 22 Months

The British pound (FXB) depreciated against the US dollar for the week ended September 29. The pound (GBB) posted a weekly close of 1.3397, depreciating by 0.71% against the US dollar (UUP).

Oct. 3 2017, Updated 9:11 a.m. ET

British pound closed September with a 3.6% gain

The British pound (FXB) depreciated against the US dollar for the week ended September 29. The pound (GBB) posted a weekly close of 1.3397, depreciating by 0.71% against the US dollar (UUP). This was the second weekly fall in the British pound, but it’s still among a few currencies that appreciated against the dollar in September. A hawkish Bank of England, suggesting rate hikes in the near term, is a key reason for the sharp rally in the pound.

British equity markets (BWX) traded on a positive note last week, and the FTSE 100 index (EWU) posted a close of 7,372—up 0.85% for the week ended September 29.

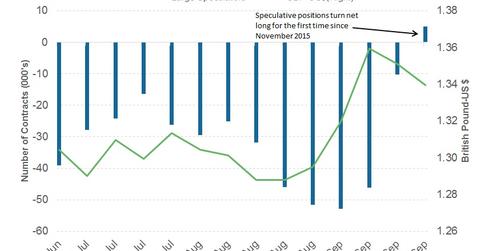

Speculators turn net bullish for the first time in 22 months

As per the latest “Commitment of Traders” (or COT) report released on September 29 by the Chicago Futures Trading Commission (or CFTC), speculators turned bullish on the British pound for the first time in 22 months. The total outstanding net positions were 5,054 long contracts, compared to 10,161 short contracts the week before. Speculators could be positioning for more gains in the pound as the Bank of England prepares to raise rates.

Week ahead for the British pound

Important economic data is due to be reported from the United Kingdom this week. The focus should be on the UK PMI (purchasing managers’ index) reports. Services, manufacturing, and construction PMI are due to be reported, and a positive reading for these indices could drive the pound higher. If these numbers also disappoint, like the recent reading in UK GDP, there could be a quick turnaround in the pound’s fortunes.

In the next part of this series, we’ll analyze how the Japanese yen has fared in last week’s low-risk environment.