Noble Energy Sets the Stage for Another Earnings Beat in 3Q16

Noble Energy (NBL) is expected to release its 3Q16 earnings results on November 2, 2016. What can investors expect?

Oct. 20 2016, Published 9:49 a.m. ET

3Q16 earnings release

Noble Energy (NBL) is expected to release its 3Q16 earnings results on November 2, 2016.

Noble Energy’s 3Q16 revenue estimates

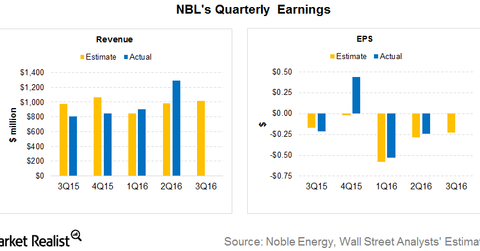

Noble Energy’s 3Q16 revenue estimate is lower than its previous quarter’s revenue. For 3Q16, its revenue estimate is ~$1 billion, ~27% higher than its 3Q15 revenue and ~21% lower than its 2Q16 revenue.

The graph above shows that Noble Energy’s revenue beat estimates in the last two quarters. Investors should watch to see if this trend continues in 3Q16.

Noble Energy’s 3Q16 earnings estimates

Noble Energy’s 3Q16 EPS (earnings per share) estimate is -$0.22. Its 2Q16 EPS were -$0.24. The corresponding quarter’s EPS in 2015 were -$0.21.

Noble Energy’s peers Rice Energy (RICE) and Chesapeake Energy (CHK) are expected to report EPS of -$0.02 and -$0.05, respectively, in 3Q16.

Key highlights and management’s comments

On May 3, 2016, NBL announced that it intended to sell ~33,000 undeveloped net acres in the DJ Basin to Synergy Resources (SYRG) for $505 million. According to a press release, these assets contributed 2% to NBL’s total production in the basin. The transaction was expected to close in June 2016.

David Stover, Noble Energy’s CEO, said in the company’s 2Q16 earnings release, “We are delivering ahead of our original expectations for the year, having enhanced both our operating capabilities and our financial strength through the first half of the year. Our performance sets us up for a strong finish this year leading into 2017.”