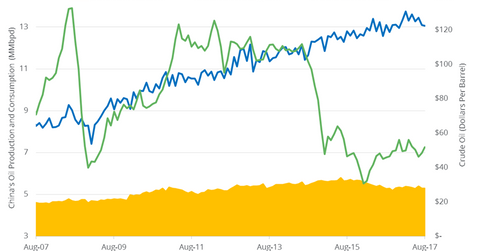

China’s Crude Oil Imports Hit a 2017 Low

China’s General Administration of Customs estimates that China’s crude oil imports fell by 180,000 bpd to 8 MMbpd in August 2017—compared to July 2017.

Sept. 21 2017, Updated 7:39 a.m. ET

China’s crude oil imports

China’s General Administration of Customs estimates that China’s crude oil imports fell by 180,000 bpd to 8 MMbpd (million barrels per day) in August 2017—compared to July 2017. Imports fell 2.2% month-over-month but rose 3.4% or by 270,000 bpd year-over-year. China’s crude oil imports are at the lowest level in eight months.

Imports fell due to fewer imports from China’s independent refiners. Some independent refiners were closed due to maintenance work from July 2017 to August 2017.

Any fall in China’s (FXI) crude oil imports is bearish for Brent and WTI crude oil (UWT) (SCO) (USO) prices. Lower imports from China have a negative impact on tanker rates. Lower tanker rates have a negative impact on oil tankers like DHT Holdings (DHT), Tsakos Energy Navigation (TNP), and Nordic American Tankers (NAT).

China’s crude oil imports in the first eight months

China’s crude oil imports in the first eight months of 2017 are at 8.44 MMbpd—12.2% higher than the same period in 2016.

China’s crude oil imports are expected to rise in 2017 and 2018 due to a rise in the demand from Chinese teapot refiners. A fall in China’s crude oil production due to aging oil fields would also contribute to more imports.

China’s refined product exports

The rise in China’s crude oil imports led to the rise in its crude oil product exports. China’s crude oil product exports rose 1.1% to 4.6 million tonnes in August 2017—compared to July 2017. It’s 24% higher than the same period in 2016. The rise in crude oil product exports put pressure on the crude oil and products’ margin.

Impact

High Chinese crude oil imports would support crude oil prices.

To learn more about crude oil price forecasts, read Hedge Funds Are Turning Bearish on US Crude Oil.

Read Are US Crude Oil Supply and Demand Tightening? and How Major Oil Producers and the Dollar Are Driving Crude Prices for more on crude oil.

Read Are US Natural Gas Supply and Demand Rebalancing? for updates on natural gas.