How Did China’s Auto Sales Trend in August?

China’s automobile industry is the second-largest steel consumer after the real estate sector.

Oct. 3 2017, Updated 10:39 a.m. ET

China’s auto demand

China’s automobile industry is the second-largest steel consumer after the real estate sector. Therefore, it is important to track the developments in this sector as well.

Auto sales recovering

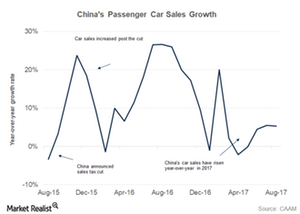

According to the China Association of Automobile Manufacturers, auto sales (XLY) in the country stood at ~2.2 million vehicles for August 2017, which implies growth of 5.3% year-over-year (or YoY). The data for the most recent months have helped soothe the fears of a slowdown in China’s auto market. In August, both the commercial vehicle and passenger car sales continued to grow in China. Year-to-date, vehicle sales have seen growth of 4.3% to 17.5 million units.

Growth rate slowing down

While the rate has steadied now, it’s nowhere close to the growth rate of 13.7% the country’s auto sales saw in 2016. This high rate of growth was due to a cut in the sales tax on small-engine vehicles from 10% to 5%. Although the tax cut is still in place, the tax rate rose to 7.5%.

Automakers (IYK) such as General Motors (GM) and Ford (F) are feeling the brunt of this slowdown in China as their sales fell 2.5% and 7.0%, respectively, in 1H17.

As we saw in the previous part, China’s property sector could be in for a slowdown. A simultaneous slowdown in growth of auto sales could be disastrous for global steel (SLX) demand. Lower steel demand also doesn’t bode well for iron ore demand. Lower demand is negative for seaborne iron ore players such as Vale (VALE), Rio Tinto (RIO), and BHP Billiton (BHP).