Can the British Pound Continue to Remain Strong This Week?

The British pound (FXB) appreciated marginally against the US dollar for the week ended September 1, 2017.

Sept. 6 2017, Updated 7:37 a.m. ET

British pound remained unchanged against the US dollar

The British pound (FXB) appreciated marginally against the US dollar for the week ended September 1, 2017. It (GBB) closed the week at 1.30, rising 0.50% against the US dollar (UUP). Economic data from the United Kingdom were better than the expectations, with improvements seen in mortgage approvals and manufacturing activity. The pound stood firm despite other currencies losing ground against the US dollar. Brexit negotiations remain inconclusive, apparently raising doubts whether the negotiations could be concluded before the two-year deadline.

The British equity markets (BWX) continued to remain positive. The FTSE 100 Index (EWU) posted a positive close at 7,438.50, a 0.50% rise for the week ended September 1.

Speculators added short positions last week

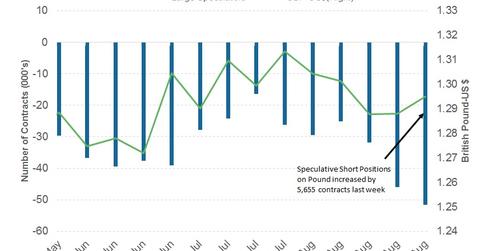

According to the latest Commitment of Traders Report released on September 1, 2017, by the CFTC (Chicago Futures Trading Commission), speculators added to their short positions on the British pound. There was an increase of 5,655 contracts against the pound, taking the total net short position of 51,555 contracts.

Week ahead for the British pound

For the United Kingdom, the main economic data release is the PMI (Purchasing Managers’ Index) service index for August on Tuesday, September 5. The other data include the Construction PMI on Monday and the GDP estimate for August on Friday. This week, the price action of the pound could likely be influenced by the demand for the US dollar and the euro.

Brexit negotiations could remain a drag on the pound’s performance as long as there is no clear path yet for Britain’s exit from the European Union.

In the next part of this series, we’ll analyze how the Japanese yen could fare in an atmosphere filled with geopolitical uncertainty.