Bristol-Myers Squibb’s Immunoscience Products

Bristol-Myers Squibb’s (BMY) Immunoscience franchise includes Orencia, which is a fusion protein used for the treatment of rheumatoid arthritis and aligned problems.

Sept. 29 2017, Updated 9:11 a.m. ET

Immunoscience products

Bristol-Myers Squibb’s (BMY) Immunoscience franchise includes Orencia, which is a fusion protein used for the treatment of rheumatoid arthritis and aligned problems.

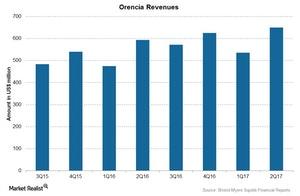

The above chart shows revenues from Orencia over the last few quarters.

Orencia

Orencia is a drug that reduces the pain in moderate-to-severe rheumatoid arthritis and also helps to reduce further joint damage. Orencia reported 10% growth in revenues to $650 million in 2Q17, compared to revenues of $593 million in 2Q16. The growth in revenues was driven by an increase in sales in US as well as international markets.

Orencia reported 12% growth in US sales to $449 million in 2Q17, compared to revenues of $401 million in 2Q16.

Other brands from Bristol-Myers Squibb

The other brands from Bristol-Myers Squibb’s product portfolio include various products that have lost exclusivity in major markets, over-the-counter products, and royalty revenues. Overall, the revenues from other brands fell ~16% to $479 million in 2Q17, compared to $572 million for 2Q16.

Other brands reported a 5% fall in US sales to $92 million in 2Q17, compared to $97 million in 2Q16.

To divest company-specific risks, investors can consider ETFs like the First Trust NASDAQ Pharmaceuticals (FTXH), which invests 4.6% of its portfolio in Bristol-Myers Squibb (BMY). FTXH also invests 8.2% in Pfizer (PFE), 9.1% in Abbott Laboratories (ABT), and 4.1% in Eli Lilly and Co. (LLY).