AMD Takes On Intel in the Data Center Processor Market

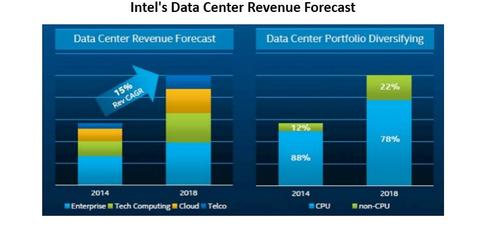

Intel controls more than 99% of the data center chip market.

Sept. 6 2017, Updated 10:37 a.m. ET

AMD’s 0.4% market share versus Intel’s 99% market share

How far can Advanced Micro Devices (AMD) go in challenging Intel (INTC) in the data center processor market? As much as AMD may make claims about its Epyc chips delivering superior performance to Intel’s equivalent chips, it is confronting a giant in the server processor market. Intel controls more than 99% of the data center chip market.

AMD has made bold claims about its data center chips before, and it controlled about 10% of the market in 2009. However, that market share has recently decreased, and research firm IDC estimates that AMD’s share of the server market in 2016 was ~0.4%.

Intel responds in kind

It appears that Intel was waiting for AMD to draw closer before it could respond at close range. Just a few weeks after AMD introduced its Epyc server processor, Intel moved to unveil upgraded versions of its server processors.

Intel noted that its new Xeon Scalable processors are ~1.7x faster than their predecessors. Among Intel’s customers, AT&T (T) also backed these claims, saying it had seen a 30% improvement in performance with the new Xeon chips.

A charged market scene

AMD appears to have provoked Intel into action and, in our view, the data center scene is likely to remain charged. Although Intel possesses a dominant market share and has moved swiftly to stem potential fallout in its base because of AMD’s Epyc, a pitched battle is shaping up in data center market.

The high-profile endorsements for AMD’s Epyc, as well as the fact that Qualcomm (QCOM) and NVIDIA (NVDA) are also making their server processor moves, could reveal a market that is rapidly heating up. Server system vendors Lenovo, Hewlett Packard Enterprise (HPE), and Dell Technologies (DVMT) are backing AMD’s Epyc.