Should We Be Worried about Greenspan’s Bond Market Warning?

Greenspan cites rapid inflation growth as the reason for a bond market collapse. But the markets and Fed officials think otherwise.

Aug. 11 2017, Updated 7:37 a.m. ET

Will the bond market bubble burst?

Alan Greenspan, who was the Fed chair until 2006, warned of a bubble in the bond markets (BIV) in an interview with Bloomberg on July 31, 2017. Greenspan predicts that US inflation (TIP) will rise too quickly and lead to a bubble burst in the bond markets. In the previous part of this series, we explained the cause of a bond market bubble. Now let’s take a closer look to see if that could happen.

Markets and Fed officials have different views

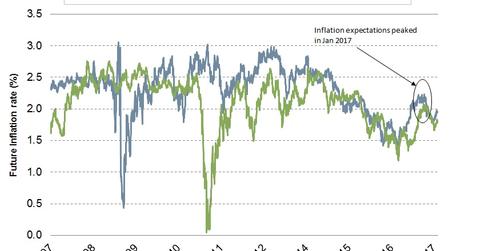

Greenspan cites rapid inflation growth as the reason for a bond market (SCHZ) collapse. But the markets and Fed officials think otherwise. Inflation has been low, below the Fed’s 2.0% target for a very long time. There was a minor uptick of expectations above this level in early 2017, driven by the optimism of President Trump’s reflation trade and improving economic conditions. But there haven’t been many reforms, and the economy is growing at a slower pace than expected in recent quarters. Fed members termed the slowdown in 1Q17 as transitory. But in its recent monetary policy statement, the Fed said it would take longer than expected to reach the 2.0% inflation target.

The Fed has been extra cautious since the taper tantrum in August 2013 and has been preparing the markets for any future policy action. It has even laid out the exact plan to shrink the Fed’s balance sheet. Going by the numbers, it would take years or even decades to bring back the Fed’s balance sheet to pre-crisis levels.

We might not see a bond bubble burst anytime soon

Inflation is likely to remain close to the 2.0% level. It’s unlikely that the current lower levels of unemployment will drive inflation higher. For more on this, be sure to read Why Minneapolis’s Fed President Voted Against a Rate Hike.

The markets have benefited from lower interest rates for a very long time and have adjusted to the possibility of rates increasing slowly. The Fed has been telling the markets (VTI) that it will ease again if required. It’s likely that the liquidity in the markets could fall marginally but not at a pace that would trigger a bond (BOND) market sell-off. Even if there is a market inefficiency, it’s likely that it could remain so for a long time.