How Market Volatility Is Trending

Volatility plays an important role in the market. VIX fell nearly 8.2% in July 2017 and 20% on a year-to-date basis.

Aug. 7 2017, Updated 9:09 a.m. ET

Market volatility

Volatility plays an important role in the market. Past geopolitical events such as China’s yuan devaluation (YINN) (FXI) and Brexit (EWU) resulted in spikes in volatility.

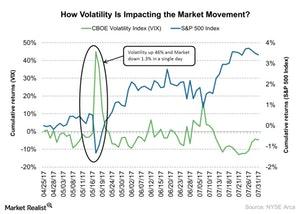

The CBOE Volatility Index (VIX), which measures volatility in the S&P 500 Index (SPY), rose nearly 143% and 56%, respectively, during the above events. VIX is also known as the “fear index.” VIX fell nearly 8.2% in July 2017 and 20% on a year-to-date basis. Volatility generally picks up when stocks fall, and vice versa.

Volatility and market performance

On one hand, the volatility index is gradually falling, while on the other hand, the market is making new highs. Investors are becoming cautious about market movement (IWM) (QQQ). However, many fund managers believe the market rally will continue.

As volatility remains near a historic low, many market participants are taking a position in VIX with the expectation of a strong rise in the near future.