Johnson & Johnson’s Consumer Segment

Johnson & Johnson’s (JNJ) Consumer segment revenues fell 1.5% to ~$13.3 billion for 2016, compared to 2015.

March 14 2017, Updated 10:36 a.m. ET

JNJ’s Consumer segment

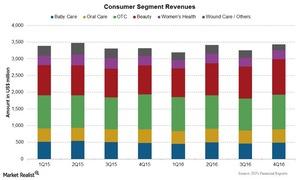

Johnson & Johnson’s (JNJ) Consumer segment revenues fell 1.5% to ~$13.3 billion for 2016, compared to 2015. This includes operational growth of 1.5%, which was more than offset by the 3% negative currency impact. The currency devaluation in Venezuela impacted worldwide growth by ~1.2% during 2016. The chart below shows the quarterly revenues for the Consumer segment.

Baby Care franchise

Johnson & Johnson’s Baby Care franchise contributed ~15% of the company’s total segment sales for 2016. The franchise’s sales fell 7.2% to $2.0 billion in 2016, including an operational decline of 2.7%. This followed the consumer shift to premium products due to competition in the US market, as well as competition in international markets.

For the US market, strong sales were reported by Aveeno baby products. For international markets, growth was driven by the Hipoglos acquisition, but Indian demonetization and lower sales of cleansers offset the growth.

Oral Care franchise

The Oral Care franchise sales fell 0.8% to ~$1.6 billion during 2016, including an operational increase of 2.0% that was more than offset by the negative impact of foreign exchange. Both the US and international markets reported growth due to successful marketing campaigns and geographical expansion of the Listerine brand.

Over-the-Counter franchise

JNJ’s Over-the-Counter franchise sales improved 2.1% to ~$4.0 billion during 2016, following increased growth of analgesics and Zyrtec, allergy medication, and relaunched digestive health products in the US.

There was also increased growth in anti-smoking aids in international markets and Imodium sales in Canada and EMEA markets, which were partially offset by the divestiture of BeTotal.

Beauty franchise

JNJ’s Beauty franchise, formerly known as the Skin Care franchise, and its sales rose 7.9% to ~$3.9 billion in 2016, following the strong performance of Neutrogena in both the US and international markets. The company also acquired beauty products from Vogue International, Light Mask, and NeoStrata in the US.

Women’s Health franchise

Johnson & Johnson’s Women’s Health franchise sales fell 11.1% to ~$1.1 billion during 2016, including an operational decline of 5.1%. The sales were significantly impacted by the currency devaluation in Venezuela. The company also divested its Tucks brand to Blistex Inc. in July 2016.

Wound Care and Others franchise

JNJ’s Wound Care franchise sales fell 23.5% to $797 million during 2016, due to the divestiture of its Splenda brand.

In the consumer sector, Johnson & Johnson’s (JNJ) major competitors include Unilever NV (UN), Nestlé S.A. (NSRGY), Kimberly-Clark (KMB), and Procter & Gamble (PG). To divest company-specific risk, investors can consider the iShares Core High Dividend ETF (HDV), which holds 5.8% of its portfolio in JNJ.