Celgene’s Abraxane Continued Steady Growth in 2Q17

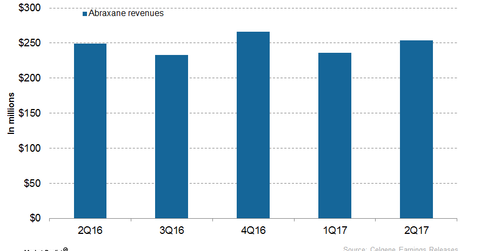

In 2Q17, Celgene’s (CELG) Abraxane generated revenues of around $254 million, which reflected ~2% growth on a year-over-year basis.

Aug. 10 2017, Updated 10:36 a.m. ET

Abraxane’s revenue trends

In 2Q17, Celgene’s (CELG) Abraxane generated revenues of around $254 million, which reflected ~2% growth on a year-over-year (or YoY) basis and 8% growth on a quarter-over-quarter basis.

In 2Q17, Abraxane’s US revenues were around $161 million, which reflected an ~7% decline YoY and ~13% growth quarter-over-quarter. Outside the US, Abraxane witnessed 25% growth on a YoY basis in 2Q17. Currently, Abraxane is the leading drug for pancreatic cancer worldwide.

The chart above represents the revenue trajectory of Abraxane from 2Q16 to 2Q17. To learn more about Abraxane, please read Why Abraxane Could See Steady Growth in 2017.

Abraxane’s growth prospects

Celgene is conducting extensive clinical trials for label expansion for Abraxane. Celgene is conducting the APACT trial for the evaluation of Abraxane and gemcitabine combination therapy compared to gemcitabine alone therapy for the treatment of individuals with resected pancreatic cancer. Celgene anticipates the results of the Phase 3 APACT study by the end of 2017.

Celgene is conducting the ABOUND Phase 3 trial for the evaluation of Abraxane and carboplatin combination therapy for the treatment of elderly individuals with advanced non-small cell lung cancer (or NSCLC).

In December 2016, Celgene presented the results of the Phase II tnAcity trial of Abraxane for injectable suspension for treatment as a first-line therapy for metastatic triple negative breast cancer (mTNBC). The Phase 2 trial demonstrated that Abraxane and carboplatin combination therapy resulted in significantly longer progression free survival (or PFS).

Abraxane plus carboplatin combination therapy had PFS of 7.4 months, while Abraxane plus gemcitabine combination therapy had PFS of 5.4 months. Gemcitabine plus carboplatin combination therapy had PFS of 6.0 months. Further studies with different combinations of Abraxane is ongoing, and Celgene anticipates results by 2018.

Celgene’s Abraxane faces competition from Roche’s (RHHBY) Tarceva and Herceptin, Novartis’s (NVS) Afinitor, Pfizer’s Sutent, and Eli Lilly’s (LLY) Alimta. The growth in sales of Abraxane could strengthen the PowerShares Dynamic Pharmaceuticals Portfolio ETF (PJP). Celgene makes ~5.5% of PJP’s total portfolio holdings.