Can There Really Be a Bubble in the Bond Market?

Fundamentally, bonds (AGG) are a discount instrument and are generally never expected to be in a bubble. Let’s see why that’s the case.

Aug. 11 2017, Updated 7:37 a.m. ET

Let’s understand bonds first

Fundamentally, bonds (AGG) are a discount instrument and are generally never expected to be in a bubble. Let’s see why that’s the case. The asset class for bonds is fixed income. As the word suggests, income from these instruments is fixed. The interest or coupon rate and the tenure of a bond are fixed at the time of its issue, whereas stocks bear no such guarantee. Investor optimism is contained with respect to bonds (BND) since the returns on their investment are unlikely to change. Once bonds (BSV) are issued, the prices of those bonds keep changing, depending on changes in the interest rate or interest rate expectations. They’re inversely related; as interest rates go up, bond prices go down, and vice versa.

Can bonds ever be in a bubble?

We’ve outlined the reasons for a bubble in the previous parts of this series. Excessive optimism drives irrational exuberance, leading to asset bubbles. In the case of bond markets, it’s the opposite. Pessimism about economic growth and spending drives bond prices higher. Does pessimism result in an asset bubble? That sounds like a trick question. Let’s try to break that down.

When will the bubble burst?

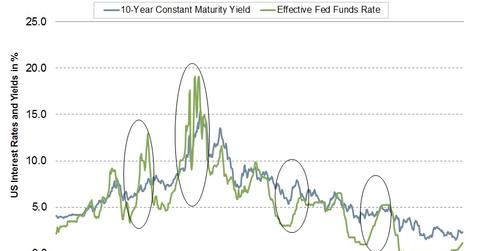

It all boils down to interest rates. Alan Greenspan believes that interest rates will have to rise too quickly once US inflation (VTIP) inches toward the 2.0% goal. This rapid rise in inflation and interest rates would have a negative impact on bond prices. Investors would likely off-load their bond holdings if bond (BLV) prices are expected to fall further. Greenspan argues for this possibility and thus warns of a bubble in the bond markets.

In the next part of this series, we’ll see if Greenspan’s warning about a bond market bubble should be taken seriously at this time.