What Could Drive BHP Billiton’s Copper Costs in Fiscal 2018?

BHP Billiton’s (BHP) copper production fell 16.0% in fiscal 2017 to 1.3 million tons.

Aug. 25 2017, Updated 10:37 a.m. ET

Copper production

Copper prices have been quite buoyant lately. In the first half of 2017, copper prices rose due to a stronger Chinese demand and supply disruptions. BHP Billiton’s (BHP) copper production fell 16.0% in fiscal 2017 to 1.3 million tons. Industrial action at the Escondida mine and the power outage and unplanned maintenance at Olympic Dam affected production during the year. Rio Tinto’s (RIO) copper production fell 21.0% year-over-year in the first half of 2017 due to the Escondida strike.

BHP expects production to improve between 1.7 million and 1.8 million tons in fiscal 2018. The improved outlook comes on the back of the following:

- ramp-up of the Los Colorados Extension

- completion of the Spence Recovery Optimization project in December 2016

BHP’s board has approved the development of the Spence Growth Option, which extends the mine life more than 50 years.

Cost reduction

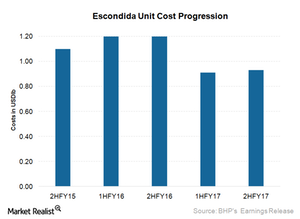

The unit costs for BHP’s copper division fell 4.0% to $1.15 per pound, excluding the impact of idle capacity and strike-related costs.

The unit costs for Escondida fell to $0.93 per pound, excluding the impact of the strike. That’s 7.0% lower than the company’s guidance. The improved costs are mainly due to continued productivity improvements and favorable inventory movements. Including the impact of industrial action, unit costs at Escondida were $1.13 per pound. BHP expects the costs for Escondida to rise to $1 per pound in fiscal 2018 due to the expected 10.0% fall in grade, according to the mine plan. For the copper division as a whole, the company expects the unit costs to remain broadly unchanged at $1.15 per pound in fiscal 2018.

What will drive copper prices?

BHP believes that in the near term, mine production from committed projects and increased scrap availability should meet the steadily growing demand for copper. In the long term, BHP believes that while demand growth should remain strong, a supply deficit should emerge in the next decade. With persisting issues in the copper industry (DBC) such as falling grades, rising input costs, water constraints, and a scarcity of future development opportunities, higher prices may be needed to attract investments in the sector.

That could be positive for companies such as Freeport-McMoRan (FCX), Teck Resources (TCK), and Southern Copper (SCCO).

In the next part of this series, we’ll see how BHP is progressing on the cost front in its petroleum division.