Will United Continental Meet Increased Capacity Growth Guidance?

At the start of the year, United announced its plan to grow its capacity by 0%–1%, in line with GDP growth expectations.

July 7 2017, Updated 7:40 a.m. ET

United Continental’s new guidance

United Continental (UAL) has always grown capacity in line with the country’s GDP growth. This is because an airline’s travel demand growth usually follows GDP growth. At the start of the year, United announced its plan to grow its capacity by 0%–1%, in line with GDP growth expectations.

However, in March, it raised its guidance by as much as 2.5%. It now expects capacity to grow by 2.5% to 3.5% for 2017. The company expected most of its capacity growth to come from its domestic markets.

Impact on industry

If United’s capacity growth isn’t mirrored by rivals like American Airlines (AAL), Delta Air Lines (DAL), and Southwest Airlines (LUV), there won’t be any major problems. However, if all major players start increasing capacity, it could lead to an overcapacity situation, which can, in turn, reduce the airline’s profitability.

However, this doesn’t seem to be the case. United Continental’s capacity growth is primarily a response to Alaska Air’s (ALK) aggressive growth in San Francisco. San Francisco is United Continental’s major hub and sitting back idly would mean losing market share to smaller Alaska Air.

United Continental has announced plans for eight additional flights, six of which correspond to Alaska’s new routes. The remaining two routes include San Francisco to Portland and San Francisco to Seattle, Alaska Air’s main hubs.

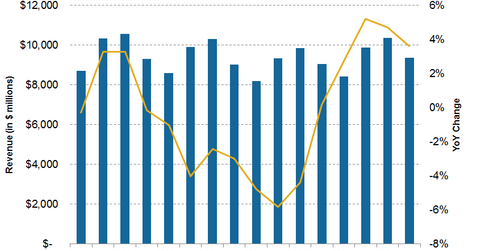

Investors can gain exposure to United Continental by investing in the PowerSharesDynamic Large Cap Value Portfolio (PWV), which invests 2.3% of its portfolio in UAL. Continue to the next article to find out United Continental’s revenue estimates.