Is Russia’s Current Account Deficit in June Temporary?

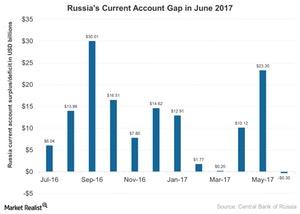

Russia’s (ERUS) current account recorded a $0.3 billion gap in 2Q17 as compared to a $23.3 billion surplus in the previous quarter and a $2 billion surplus in the same period.

July 24 2017, Updated 6:05 p.m. ET

Russia’s current account in 2Q17

Russia’s (ERUS) current account recorded a $0.3 billion gap in 2Q17 as compared to a $23.3 billion surplus in the previous quarter and a $2 billion surplus in the same period the previous year. The current account gap in June 2017 mainly resulted from an increased services deficit as compared to a trade surplus in the same period. Let’s look at the current account balance in Russia over the last year in the below chart.

Current account deficit in 2Q17

Russia (RSX) has reported a current account deficit in 2Q17 since the third quarter of 2013. The services deficit rose to $7.1 billion in 2Q17 from the $6 billion gap in 2Q16. Meanwhile, the trade surplus widened to $24.8 billion in 2Q17 from $22.3 billion in 2Q16, mainly due to higher oil and gas revenues. The deficit in investment income increased to $16 billion in 2Q17 from $12.8 billion in 2Q16.

Surplus in current account balance in 1H17

The current account balance gives insight into the economic health of a country. Russia’s current account surplus in the first half of 2017 increased to $23 billion as compared to $14.9 billion in the same period the previous year. According to the Bank of Russia, the trade balance improved in the first half of 2017 mainly due to favorable prices for the country’s primary export commodities. The improved commodity (DBO) prices also influenced the growing deficit balances on trade in services and income for Russia (EEM) in 2017.

The net private capital outflows amounted to $14.7 billion as compared to $8.6 billion in the same period the previous year. The increased capital outflow in 2017 was mainly due to the higher net private capital outflows, mostly in the banking sector’s transactions related to resident client accounts at the beginning of 2017. The active repayment of external debt liabilities by banks also increased the capital outflow in 1H17. However, other sectors experienced increased inflow of foreign capital amid improved economic recovery.

Expectations

The increasing current account surplus of Russia (RUSL) provides a cushion for the Russian economy in the current uncertain times due to the economic sanctions by the US (SPY) and Europe (VGK) resulting from the geopolitical tension around the Crimean region.

The recovery of commodity prices since last year has led to the increased current account balance for the first half of 2017. However, lately, the commodity prices are on a decline in 2017, which might affect the current account surplus in the next quarters in 2017.

Let’s look at the performance of the Russian ruble in our next article.