How Schlumberger Correlates with Crude Oil

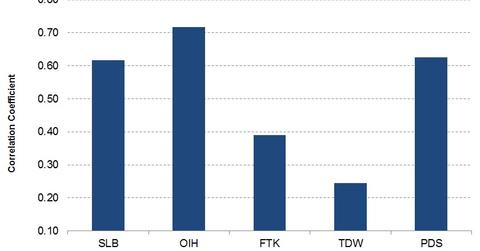

The correlation coefficient between the West Texas Intermediate (or WTI) crude oil price and Schlumberger’s (SLB) stock price between August 4, 2016, and August 4, 2017, is 0.62.

Aug. 8 2017, Updated 8:10 a.m. ET

Correlation between Schlumberger and crude oil

The correlation coefficient between the West Texas Intermediate (or WTI) crude oil price and Schlumberger’s (SLB) stock price between August 4, 2016, and August 4, 2017, is 0.62. This means Schlumberger and crude oil prices have been closely correlated in the past year.

What does SLB’s correlation with crude oil mean?

Investors may note that a high correlation may be good for SLB’s stock price, as crude oil prices have strengthened in the past couple of weeks. Since June 21, 2017, the West Texas Intermediate crude oil price has recovered 17% after it fell considerably over the past four months. However, analysts do not expect a significant rise in crude oil price in the imminent future. SLB’s correlation with the crude oil price has decreased in the trailing year to August 2017 compared to the previous year to August 2016.

Correlation between SLB’s peers and crude oil

The VanEck Vectors Oil Services ETF’s (OIH) correlation with crude oil since August 4, 2016, is 0.72. OIH’s correlation with crude oil is higher in the trailing year to August 4, 2017, versus the previous year. Flotek Industries’ (FTK) correlation coefficient since August 4, 2016, is 0.39, while Tidewater’s (TDW) correlation coefficient since August 4, 2016, is 0.24. Precision Drilling Corporation’s (PDS) correlation coefficient during the same period is 0.63.

Learn more about the OFS industry in Market Realist’s The Oilfield Equipment and Services Industry: A Primer.