Precision Drilling Corp

Latest Precision Drilling Corp News and Updates

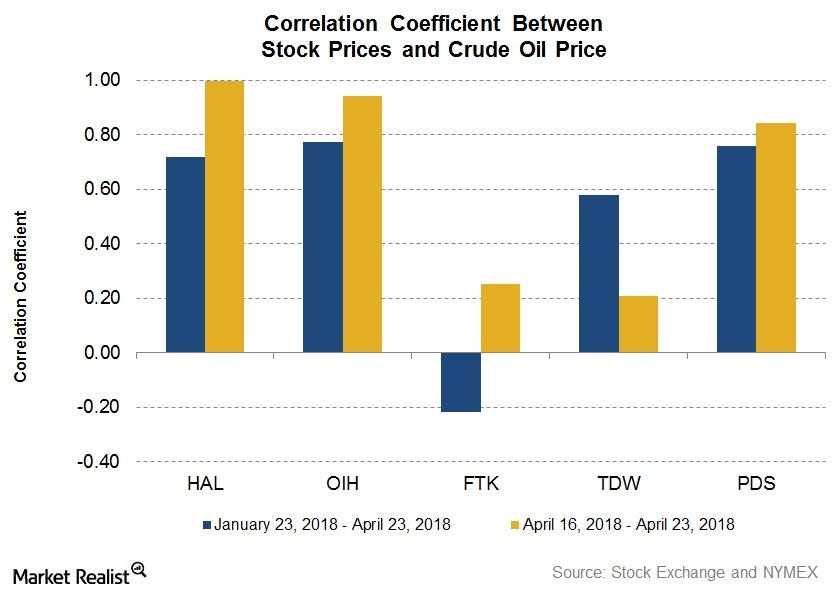

How Halliburton Has Reacted to Crude Oil Prices

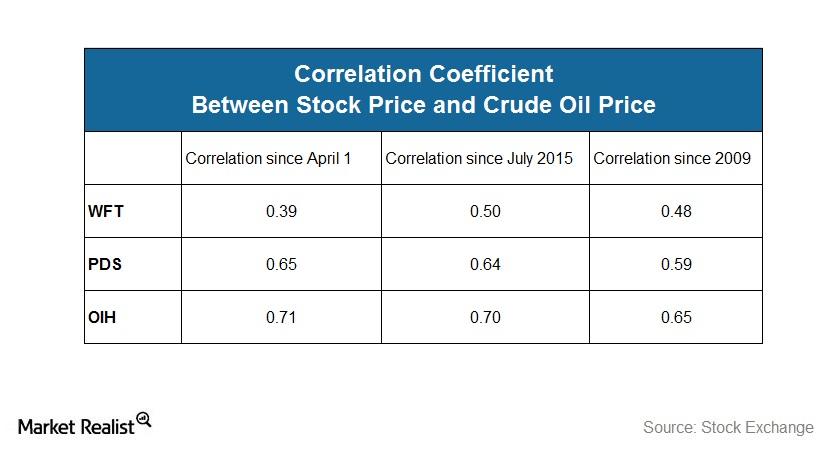

Between April 16 and April 23, Halliburton (HAL) stock’s price correlation with crude oil was 0.99, showing that Halliburton and crude oil prices have been strongly correlated in the past week.

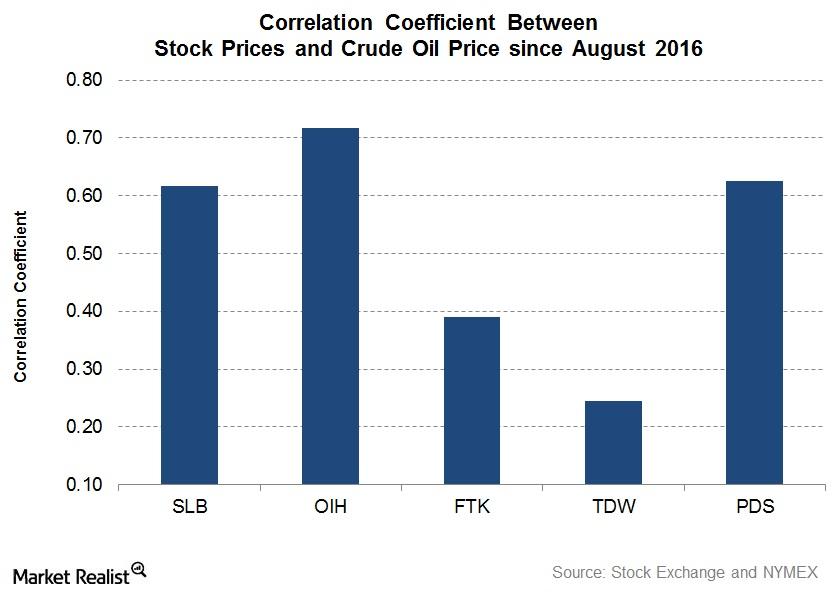

How Schlumberger Correlates with Crude Oil

The correlation coefficient between the West Texas Intermediate (or WTI) crude oil price and Schlumberger’s (SLB) stock price between August 4, 2016, and August 4, 2017, is 0.62.

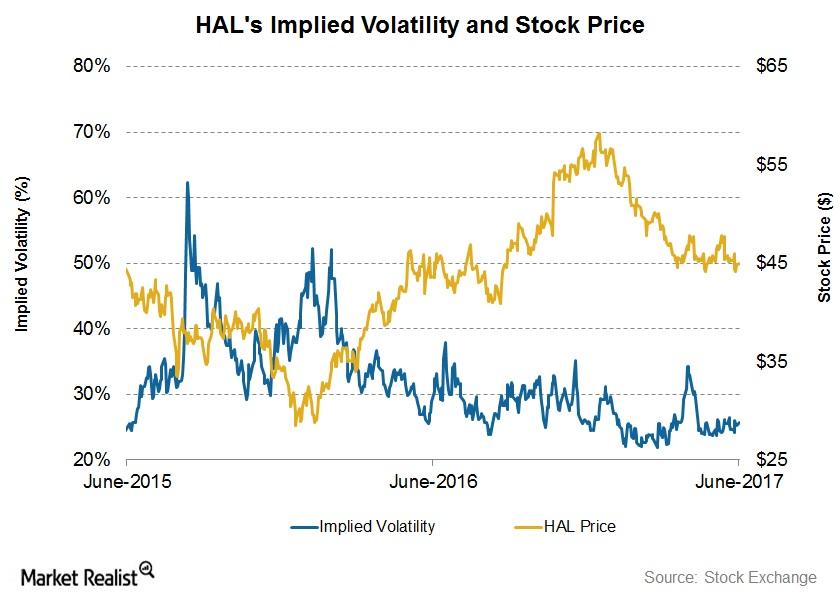

What Investors Can Expect from Halliburton

On June 13, Halliburton’s implied volatility was 24.1%. Since its 1Q17 financial results were announced on April 24, its implied volatility has fallen.

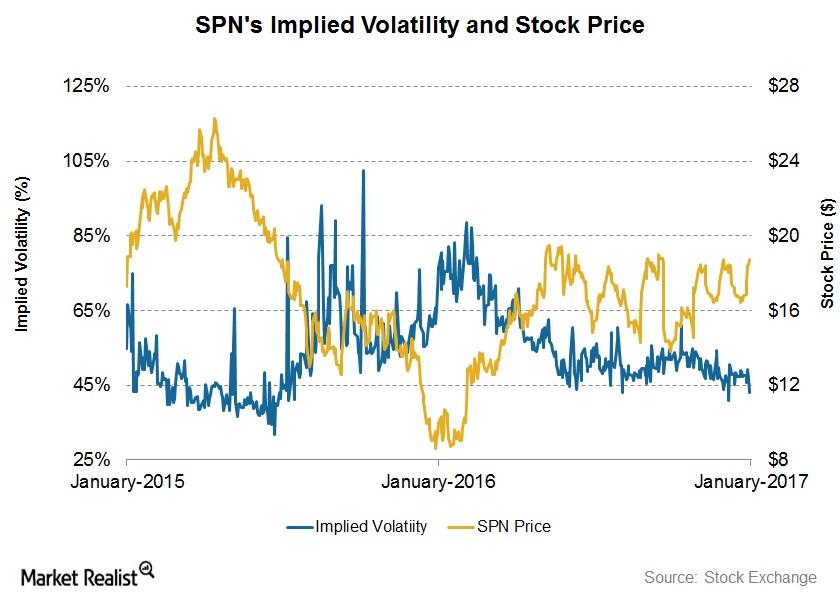

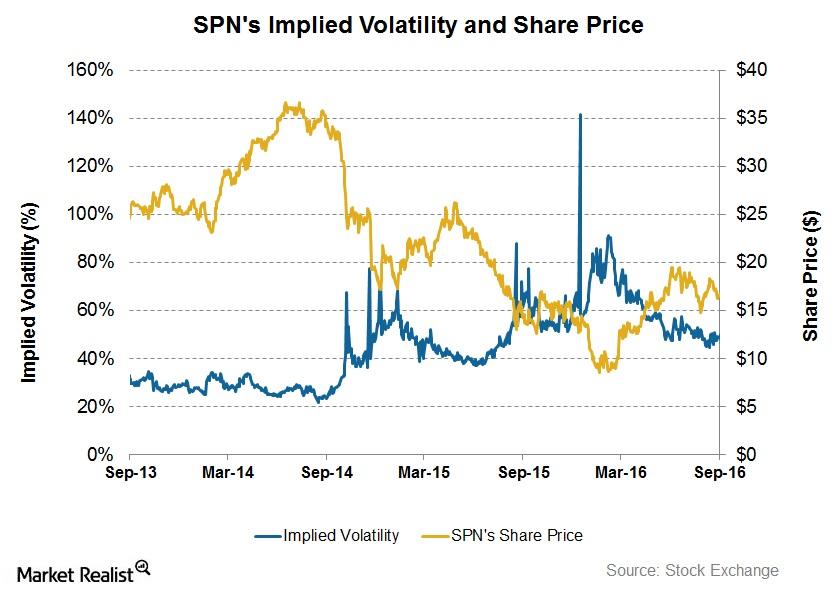

How Volatile Is Superior Energy Services in 1Q17?

On January 6, SPN had an implied volatility of ~43%. Since SPN’s 3Q16 financial results on October 24, 2016, its implied volatility has fallen from 54%.

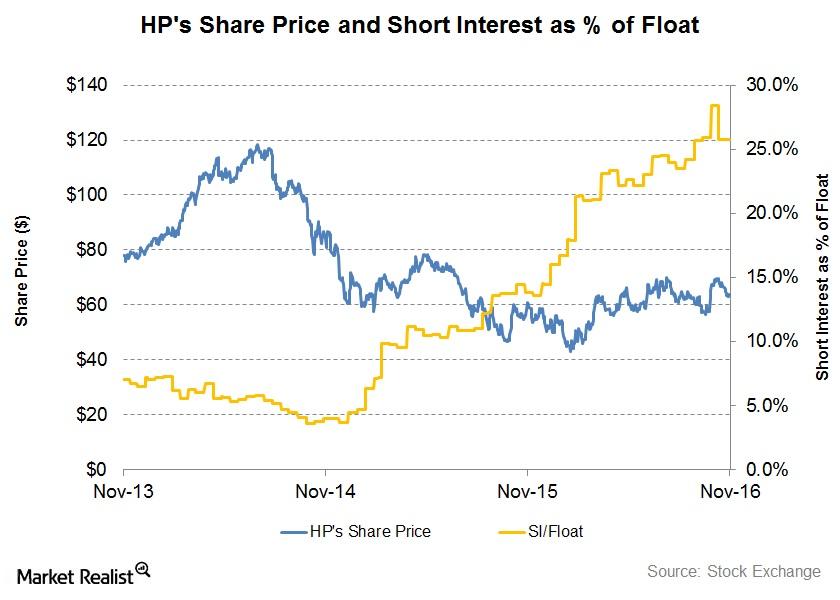

Has Helmerich & Payne’s Short Interest Decreased since Fiscal 3Q16?

Helmerich & Payne’s (HP) short interest as a percentage of its float was 25.7% on November 2, compared to 24.5% on June 30. Since the end of fiscal 3Q16, HP’s short interest has increased 5%.

Is It Time for SPN’s Options Traders to Make a Move?

On September 14, 2016, Superior Energy Services (SPN) had an implied volatility of ~51%.

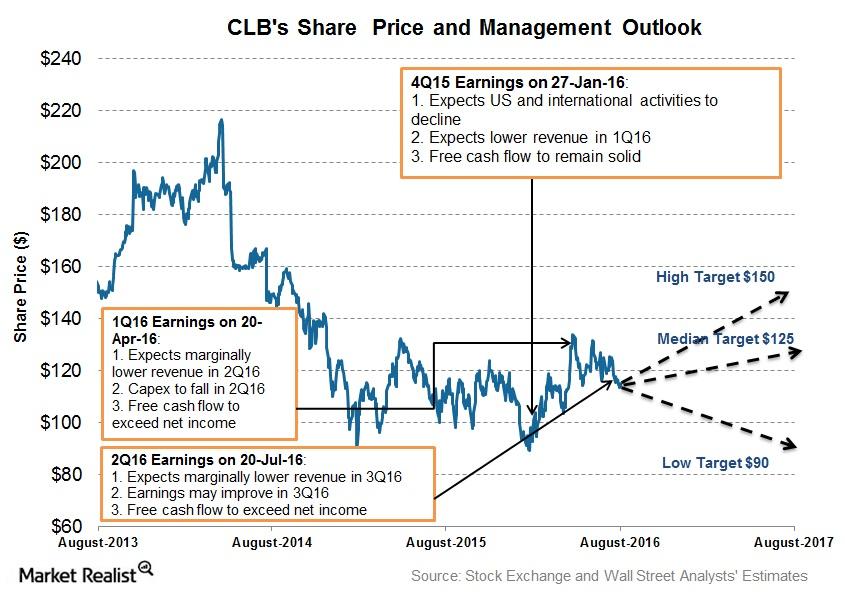

Inside Core Laboratories’ Management Projections for 3Q16

Core Laboratories expects onshore energy production to fall by the end of 2016 and net production of legacy deepwater projects to offset onshore declines.

Has WFT’s Correlation with Crude Oil Fallen since 1Q16?

In this article, we’ll analyze the correlation between Weatherford International’s (WFT) stock price and West Texas Intermediate (or WTI) crude oil’s price.