Analysts’ Latest Recommendations for Johnson & Johnson

Johnson & Johnson (JNJ) missed Wall Street analysts’ revenue estimates in 1Q17. It reported revenue of $17.8 billion in the quarter.

July 17 2017, Updated 10:39 a.m. ET

Analysts’ estimates

Johnson & Johnson (JNJ) missed Wall Street analysts’ revenue estimates in 1Q17. It reported revenue of $17.8 billion in the quarter, compared to analysts’ consensus estimate of $18.0 billion.

However, the company surpassed analysts’ estimates for EPS (earnings per share) in 1Q17. It reported EPS of $1.83 in the quarter, compared to the estimate of $1.76. Analysts expect Johnson & Johnson to generate EPS of $1.80 on revenue of $19.0 billion in 2Q17.

Some of JNJ’s biggest growth drivers include the restructuring of its business segments and the strong performances of its key products in the following franchises:

- immunology and oncology in the Pharmaceuticals segment

- beauty care products and over-the-counter products in the Consumer Healthcare segment

- orthopedics, specialty surgery, and vision care in the Medical Devices segment

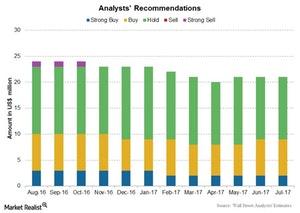

Analysts’ ratings and recommendations

JNJ’s stock price has risen nearly 7.2% in the last 12 months and nearly 14.4% year-to-date. Analysts expect the stock’s price to rise 1.4% over the next 12 months. Analysts’ recommendations show a 12-month target price of $133.67 for the stock, compared to its price of $131.86 on July 13, 2017.

As of July 14, 2017, 21 analysts are tracking Johnson & Johnson. Of these, nine analysts have recommended “buys” on the stock, while 12 have recommended “holds.” No analysts have recommended “sells” on JNJ.

Changes in analysts’ estimates and recommendations are based on changing trends in the price and performance of the company. The consensus rating for Johnson & Johnson stands at 2.48, which represents a moderate “buy” for value investors.

To divest risk, investors can consider ETFs such as the VanEck Vectors Pharmaceuticals ETF (PPH), which holds 8.6% of its total assets in Johnson & Johnson. PPH also holds 6.3% in Novartis (NVS), 5.0% in Novo Nordisk (NVO), and 4.9% in AstraZeneca (AZN).