Why Bundesbank’s Weidmann Sees Political Pressures Ahead

At an event in Germany, Weidmann highlighted the risks of prolonged quantitative easing.

July 3 2017, Updated 9:10 a.m. ET

Quantitative easing leads to political pressures

The President of Bundesbank (Germany’s central bank), Jens Weidmann, has been a vocal in his view that the current economic outlook for Europe and the balanced risks faced by the economy warrant a change in the forward guidance from the ECB (European Central Bank). At an event in Germany, Weidmann highlighted the risks of prolonged quantitative easing.

Sovereign bond purchases are problematic

Weidmann said that the purchase of government bonds of European nations (BWX) (IGOV) (BWZ) distorts the relationship between monetary policy and fiscal policy. He stressed that the exercise of bond buying by the ECB negates the influence of capital markets to discipline different governments within the EU.

Understanding fiscal policy

Many governments issue debt in the form of bonds to raise capital for fiscal spending. Depending on the risk profile and sovereign rating for each of these countries, investors in capital markets bid for these bonds.

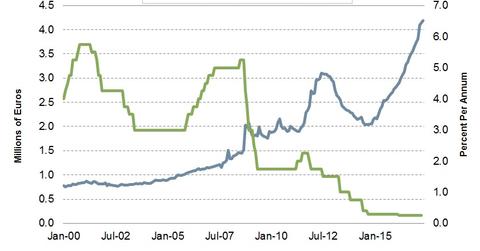

Yields, or the required rate of interest for these bond issues, are dictated by market demand, but with quantitative easing, the ECB is buying these bonds to keep yields lower, thereby controlling interest rates.

Weidmann argues that “risk differentiation between the different countries is significantly reduced” because of quantitative easing, which “can lead to political pressure being exerted on the euro system to maintain the very accommodative monetary policy for longer than appropriate from a price stability standpoint.”

Exit steps

Weidmann is not alone in his argument and has support from other ECB members, including Austrian Central Bank President Ewald Nowotny and ECB governing council member Jan Smets.

It appears, in any case, that the ECB is trying to prepare markets for a gradual reduction of stimulus, while markets (VGK) (IEF) are moving ahead of the announcement. The next ECB meeting is scheduled for July 20. We can expect more clarity from the ECB in that statement.

In the next part, we’ll look at how the Bank of England has surprised markets with its hawkish view.