Why S&P 500 Speculative Bets Are off the Table

CFTC data released on Friday indicated that commercial traders maintained a net position of 5,756 contracts in the previous week.

May 22 2017, Published 3:23 p.m. ET

Markets have a lower appetite for speculative bets on S&P 500

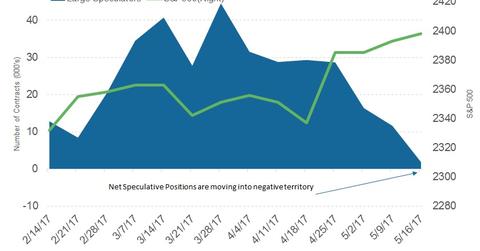

As per the Commitment of Traders (or COT) report, which is released by the Commodity Futures Trading Commission (or CFTC) on Friday, non-commercial positions have witnessed a marginal reduction in short positions compared to the previous week. Non-commercial positions are held by large speculators like hedge funds and asset managers.

As of May 16, the total net positions held by large speculators and hedge funds stood at -4,570, which indicates a marginal gain of 828 contracts from the previous week. Investors have moved into a net short position in the S&P 500 (SPY) Index over the last few weeks, indicating that the euphoria over trump trade is fading.

Commercial positions have continued to fall

CFTC data released on Friday indicated that commercial traders maintained a net position of 5,756 contracts in the previous week through Tuesday as compared to 6,905 contracts in the previous week. Commercial positions have fallen by 1,149 contracts. The reason could be that investors were doubting if the S&P 500 could cross the 2,400 mark.

These positions were only on the rise until May 16. The risk-off sentiment and volatility (VXX) crept in only on May 17, so we’ll get an actual sense of investor sentiment from next week’s data.

The next week will keep investors on the edge

Markets (ITOT) (IWV) have gotten through the initial jitters of the Comey memo and managed to end last week with minor losses. Next week, investors will have an eye on Comey’s testimony and President Trump’s travels in Saudi Arabia, Israel, and the Vatican. Equity markets (MTUM) will be waiting to see if the Trump can make any trade deals during his travels.

In the next part of this series, we’ll analyze how the US dollar reacted to the Trump saga.