Peru’s Flood and the IMF

Peru is one of the fastest-growing economies among emerging markets.

May 17 2017, Updated 7:37 a.m. ET

Economic growth in Peru

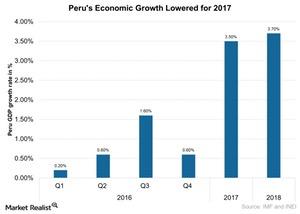

Peru (EPU) is one of the fastest-growing economies among emerging markets (EEM). It had an average GDP growth rate of 1.5% on a quarter-over-quarter basis from 2002 to 2012, though its growth estimate for 2017 is expected to be lower, considering its recent floods in March 2017.

The unforeseen flood damage was caused by ENSO (El Niño Southern Oscillation) weather, which particularly affected Lima and cities in Northwestern Peru. However, infrastructure overhaul in Peru is expected to provide a significant boost in coming years.

Economic growth in Peru

Peru’s GDP rose by 0.60% in 4Q16 over the previous quarter. Peru’s economy grew by around 0.5% in March 2017, beating expectations, according to Peru’s Economy Ministry.

But lately, Peru’s economy has been impacted by the slower implementation of infrastructure projects due to a corruption investigation involving Brazil’s Odebrecht. Odebrecht is a Latin American (ILF) construction giant and has built some of the region’s most important infrastructure projects.

IMF estimate for Peru’s 2017 growth

The IMF (International Monetary Fund) estimate for 2017 growth in Peru was also lowered to 3.5% due to the recent flooding and the persistent delays in the execution of approved public sector investment projects. Recently, a gas pipeline works in Southern Peru—a project worth more than $7.3 billion—was delayed due to an inability to finalize financing for the project.

The forecasted GDP growth for 2017 is expected to be primarily driven by a larger contribution from domestic demand. Private investments and public spending are expected to advance slowly in 2017, particularly with the reduction in mining investments we’ve seen lately. Higher imports and moderation in exports are expected to affect the contributions of the external sector to GDP growth in 2017.

The investment scenario in Peru

Latin American markets had an impressive year in 2016. In Peru, investors have been showing an increased appetite for domestic assets, and the domestic currency, the Peruvian sol, has appreciated more than 2% against the US dollar in 2017 so far.

Still, among Latin American single country ETFs, the iShares MSCI All Peru Capped ETF (EPU) is struggling to post gains as compared to peers (EWZ) (EWW). EPU has gained only ~5% so far in 2017 (as of May 12).

In the next part, we’ll take a closer look at Colombia.