What Led to the Demand Growth for Green Bonds?

The World Bank has projected an annual investment by cities of $100.0 billion through 2050 to prevent the harmful impact of climate change.

Oct. 8 2020, Updated 4:55 p.m. ET

VanEck

GRNB Meets Growing ESG Demand as First U.S.-Listed Green Bond ETF

GILLIAN KEMMERER: Welcome to Asset TV. I’m Gillian Kemmerer. Today VanEck is ringing the closing bell here at the New York Stock Exchange in celebration of the debut of the first Green Bond ETF (GRNB) in the United States. I’m joined by Ed Lopez, the Head of ETF Product Management at VanEck to tell us more about the debut. Ed, why was the VanEck Vectors Green Bond Fund launched?

ED LOPEZ: At VanEck we have a long history of developing forward thinking and intelligently designed ETFs that we think add value to an investor portfolio. Whether it is improving the way investors access core areas of the marketplace or simply providing access to new and evolving areas of the market. The purpose of our new Green Bond ETF is to provide access to a new segment of the market for which there is great deal of demand. To put this in perspective, just as financial markets evolve, so do investor values and preferences.

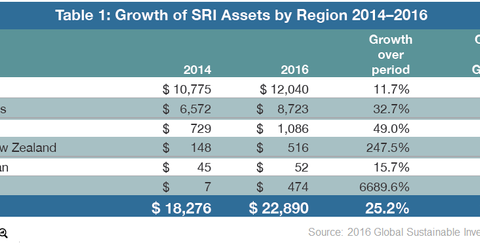

We are seeing a mind shift in the investment landscape in terms of investor preference towards ESG-type investing [environmental, social and governance] or investing that has some kind of positive societal or environmental impact. For instance, the US SIF, which is the Forum for Sustainable and Responsible Investment, recently released its 2016 biannual report, which indicated that assets tied to ESG strategies eclipsed $8.2 trillion in the U.S. in 2016. Compared to 2014, this represents a 33% increase. Globally, at the end of 2014 assets tied to ESG strategies were $21 trillion. Clearly the demand from investors to direct funds towards impactful causes is there. An outgrowth of this demand has been the green bonds market, which now at $200 billion in total size, reflects a doubling of growth of over the last couple of years, each year; and the market is expected to double again this year.

Market Realist

A brief backdrop

Energy (USO) (UNG) produced from fossil fuels in the form of coal, natural gas, and oil contributes massively to climate change. They’re the leading generators of toxins leading to health hazards and environmental risks. So it has become increasingly important for energy investors and the public to recognize the need for a cleaner, more reusable energy future.

The World Bank and the European Investment Bank initially started issuing green bonds (GRNB) between 2007 and 2008. Private sector issuers including corporates and commercial banks started issuing the bonds in 2013.

Green bonds are bonds with tax exemptions and contribute to fighting climate change in some way or another. Some issuers of green bonds include the following:

- World Bank

- Commonwealth of Massachusetts

- City of Johannesburg

- Toyota Financial Services

- Regency Centers Corporation

- Environmental Defense Fund

- Export Development Canada

Some of the green bond issues in 2017 include the following:

- Bonds worth $559.0 million issued by the Spanish (EWP) (HEWP) oil giant Repsol

- IFC’s investment worth $154.0 million in green bonds issued by Poland’s (EPOL) (PLND) Bank Zachodni WBK

- Bonds worth 5.0 million pounds by the United Kingdom’s (EWU) (HEWU) Green Deal Finance Company

- Bonds worth $450.0 million by India’s (INDA) (EPI) ReNew Power

- Bonds worth $7.5 billion by France (EWQ)

Future outlook

The World Bank has projected an annual investment by cities of $100.0 billion through 2050 to prevent the harmful impact of climate change. The United Nations has estimated an annual investment of $1.0 trillion by global economies toward sustainable infrastructure development to dispel the effects of climate change.