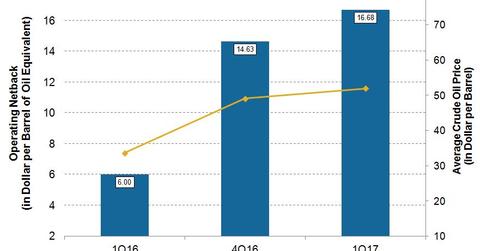

Devon Energy’s Operating Netbacks

In 1Q17, Devon Energy’s (DVN) reported operating netback was ~$16.68 per boe (barrel of oil equivalent), which is ~178% higher than in 1Q16.

May 25 2017, Updated 7:35 a.m. ET

Devon Energy’s operating netbacks

In 1Q17, Devon Energy’s (DVN) reported operating netback was ~$16.68 per boe (barrel of oil equivalent), which is ~178% higher than in 1Q16. Operating netback (also referred to as production netback) is the oil and gas revenue realized per boe after all the costs to bring one barrel of oil equivalent to the marketplace are subtracted from the realized price.

Operating netback is derived by subtracting field operating expenses (or production expenses), production taxes, and transportation expenses from the realized price, including its hedging benefit.

Due to higher energy prices, other upstream companies like ConocoPhillips (COP) and Marathon Oil (MRO) have also reported higher operating netbacks on a year-over-year basis. COP and MRO constitute ~0.31% and ~0.07% of the SPDR S&P 500 ETF (SPY), respectively.

A smaller player in the upstream space, Diamondback Energy (FANG) has an operating netback of ~$33.99 per boe.