Crude Oil Is Stable amid Lower Inventory Levels

After falling to five-week low price levels on May 2, crude oil prices are stable in the early hours on May 3. The market opened higher on Wednesday.

May 3 2017, Published 7:46 a.m. ET

Crude oil

After falling to five-week low price levels on May 2, crude oil prices are stable in the early hours on May 3. The market opened higher on Wednesday amid the supporting oil inventory report.

API’s inventory report

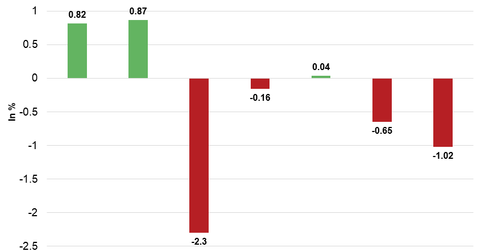

According to data released by the API (American Petroleum Institute) on May 2, crude oil inventory levels for the week ending April 28 fell by 4.16 MMbbls (million barrels). The market expected inventory levels to fall by 2.3 MMbbls. A larger-than-expected fall supported crude oil prices. The sentiment has been mixed in the crude oil market amid expectations of a supply cut agreement extension and an increase in US shale oil production and oil rigs. The market is looking forward to the release of the EIA’s crude oil inventory report at 10:30 AM EST today.

At 6:30 AM EST on May 3, the West Texas Intermediate crude oil futures contract for June 2017 delivery was trading at $48.03 per barrel—a gain of ~0.78%. The Brent crude futures contract for July 2017 delivery rose ~0.83% to $50.88 per barrel. The PDR S&P Oil & Gas Exploration & Production ETF (XOP) closed at $34.67 after falling 0.63% on May 2.

Metals

After pulling back on Tuesday, copper continued to weaken and traded at the lowest levels in a week in the early hours on May 3. Copper is weaker due to the slowdown in China’s manufacturing activity. Considering that China is the largest copper consumer, the demand for copper in China influences copper’s overall price and demand trends.

At 6:30 AM EST on May 3, the COMEX copper futures contract for July 2017 delivery was trading at $2.57 per pound—a fall of ~2.3%. The PowerShares DB Base Metals ETF (DBB) fell 0.5%, while the SPDR S&P Metals & Mining ETF (XME) rose 0.3% on May 2. Gold (GLD) and silver (SLW) are weaker in the early hours amid the strong dollar. The firmer dollar weighs on dollar-denominated commodities such as copper and gold. Platinum and palladium were also weaker in the early hours on May 3.