Why Novartis’s 1Q17 Revenues Missed Analysts’ Estimates

Novartis (NVS) released its 1Q17 earnings on April 25, 2017, reporting a 25.0% rise in revenues at constant exchange rates compared to 1Q16.

April 27 2017, Published 2:01 p.m. ET

A look at Novartis’s 1Q17 earnings

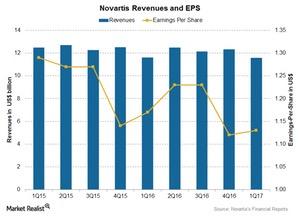

Novartis (NVS) released its 1Q17 earnings on April 25, 2017, reporting a 25.0% rise in revenues at constant exchange rates compared to 1Q16. Its revenues missed Wall Street analysts’ estimate. However, the company surpassed analysts’ EPS (earnings per share) estimate and reported EPS of $1.13 on revenues of $11.5 billion. The EPS estimate was $1.12 on revenues of $11.7 billion.

Stock price performance

Novartis stock rose ~2.2% to close at $76.24 on April 25, 2017. Its previous day’s closing price was $74.61. The stock rose further on April 26, 2017, closing at $76.35 due to the positive response of investors to its 1Q17 earnings. Overall, Novartis stock has fallen nearly 0.70% over the last 12 months.

1Q17 performance

Novartis’s top line fell 1.0% to $11.5 billion in 1Q17, driven by an operational growth of 2.0% and a 3.0% negative impact of foreign exchange. At constant exchange rates, revenues for Novartis’s Innovative Medicines segment, formerly the Pharmaceuticals segment, rose 2.0%. Revenues for Alcon, its eye care business, rose 1.0% in 1Q17. Sandoz, its generic pharmaceuticals business, reported a 1.0% rise in 1Q17 revenues at constant exchange rates.

The company reported a volume growth of 7.0% in 1Q17, partially offset by pricing issues due to competition and the negative impact of foreign exchange.

To divest the risk, you can consider ETFs such as the iShares Global 100 (IOO), which holds 2.0% of its total assets in Novartis. IOO also holds 3.1% of its total assets in Johnson & Johnson (JNJ), 1.8% in Merck & Co. (MRK), 1.0% in Sanofi (SNY), and 1.0% in GlaxoSmithKline (GSK).