Should Cliffs Worry about Chinese Steel Price Trends?

Among the most dominant factors driving the recent iron ore price rally are higher steel production and the rise of steel prices in China (FXI).

April 12 2017, Updated 10:36 a.m. ET

China’s steel prices

Among the most dominant factors driving the recent iron ore price rally are higher steel production and the rise of steel prices in China (FXI).

We need to see if the same factor will keep iron ore prices buoyant in 2017 as well. The answer lies in the underlying demand trends for steel in China and elsewhere.

Outlook: Lower prices?

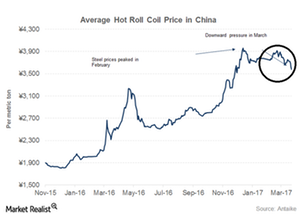

After rising steadily in 2016 and January 2017, Chinese steel prices have come under pressure over the last few weeks. According to data compiled by Antaike, average HRC (hot-rolled coil) prices have fallen almost 10% since their February 2017 highs. China’s Iron and Steel Association (or CISA) thinks the country’s steel demand should fall 1.9% in 2017. This fall would hurt steel prices and, ultimately, iron ore prices.

Impact on mining companies

Chinese steel prices and seaborne iron ore prices move in tandem. Many analysts believe we could see a moderation in iron ore prices in 2017. Any fall in steel prices could pressure iron ore prices. Also, if global steel prices follow Chinese steel prices down, US steel mills could find it tough to justify higher selling prices, which would be negative for Cliffs Natural Resources.

China’s cutbacks in domestic steel production could result in falling iron ore imports from seaborne suppliers such as Rio Tinto (RIO), BHP Billiton (BHP)(BBL), Vale (VALE), and Cliffs Natural Resources (CLF).