How High-Yield Bonds Are Connected to Other Asset Classes

AB Looks Are Deceiving But even though high-yield bonds look like other bonds, they don’t necessarily act like other bonds. This insight can have important implications for how investors consider them in an overall portfolio context. High-yield performance patterns, for example, don’t track those of other fixed-income sectors very closely over the long term. Looking […]

April 10 2017, Published 12:37 p.m. ET

AB

Looks Are Deceiving

But even though high-yield bonds look like other bonds, they don’t necessarily act like other bonds. This insight can have important implications for how investors consider them in an overall portfolio context. High-yield performance patterns, for example, don’t track those of other fixed-income sectors very closely over the long term. Looking back almost 30 years, US high-yield bonds have exhibited a correlation of only 0.22 to a broad universe of investment-grade bonds, and a correlation of 0.14, to US Treasury bonds, the traditional bellwethers of the US bond market.1 Of course, these correlations aren’t constant—they fluctuate substantially over time. Based on a rolling three-year average, high yield’s correlation to US Treasuries has ranged from as low as –0.09 to as high as 0.41.

High yield’s long-term correlation to US stocks, as measured by the S&P 500 Index, has been 0.61; to global stocks, as measured by the MSCI World Index, it’s been 0.60. These correlations show clearly that high-yield bonds have tracked stocks more closely than they’ve tracked bonds.

Why is this? High-yield bonds, like equities, are strongly linked to the business results and fundamentals of the companies they represent. And credit spreads, the incremental yield that high-yield bonds offer versus same-duration government bonds, tend to move inversely with interest rates. This leaves high-yield bonds generally insensitive to interest rates—the dominant risk factor for many investment- grade bond sectors.

This sensitivity, however, isn’t constant over time. It’s typically greater when high-yield spreads are lower—correlation is positive, although modest. When yield spreads are wider, on the other hand, the correlation is often negative.

This is important, because the last few years of record-low interest rates have increased the popularity of high-yield bonds, compressing spreads to below their long-term historical average. A rapid increase in interest rates could cause high yield to underperform equities. Tighter spreads can make valuations less compelling, and might moderate returns in the short run. But they don’t, in our view, diminish high yield’s ability to diversify portfolios and improve the consistency of returns over longer time frames.

Market Realist

Relationship between high yield bonds and other asset classes

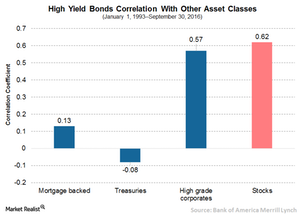

As discussed above, high yields (HYG) (PHB) have exhibited a very high correlation with equities. According to Bank of America Merrill Lynch, between 1993 and 2016, high yield bond returns recorded a -0.08 correlation with Treasuries, a 0.57 correlation with investment-grade bonds, and a higher correlation of 0.62 with equities.

The correlation between high yield bonds and equities is very strong, especially when the economy is improving. The opposite is true when the economy is declining. The high correlation is due to the various equity-like characteristics of high yield bonds, such as higher risks and returns. On the other hand, high yield bonds have a very low correlation with investment grade bonds and government bonds. Due to this low correlation, high yield bonds often generate higher returns during rising interest rates, owing to wider spreads and improving credit conditions. As a result, high yield bonds (ANGL) often act as effective diversifiers for bond portfolios. In fact, high yield bonds with stocks can generate higher risk-adjusted returns while reducing overall volatility.

Some important characteristics of high yield bonds include:

- higher risk-adjusted returns

- less sensitive to interest rate fluctuations than investment-grade and Treasury bonds

- low correlation to investment-grade bonds and Treasuries

Rising interest rates and high yield bonds

As high yield bonds (JNK) are less sensitive to interest rate risks, rising rates pose no substantial threat to high yield bonds (IHY). On the contrary, rising rates are beneficial. Interest rates rise in response to an improving economy, which boosts earnings for most corporates. In such an environment, companies issuing high yield bonds are likely to see lower default rates.

AB

1US high-yield bonds are represented by the Barclays US Corporate High-Yield 2% Issuer Capped Bond Index; US Treasury bonds by the BofA Merrill Lynch Current 5-Year US Treasury Index; and investment-grade bonds by the Barclays US Aggregate Bond Index.