This Is Driving Merck’s Vaccines Business

The Gardasil franchise is Merck’s (MRK) leading vaccines franchise.

March 28 2017, Updated 9:06 a.m. ET

Gardasil franchise

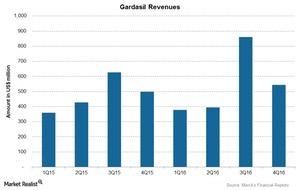

The Gardasil franchise is Merck’s (MRK) leading vaccines franchise. Gardasil is a vaccine for the prevention of certain strains of human papillomavirus (or HPV). Total sales of the Gardasil franchise in 2016 were $2.2 billion, an increase of ~14% over $1.9 billion for 2015.

Why is the Gardasil franchise important?

Gardasil is used in the prevention of certain HPV strains that are responsible for causing ~70% of cervical cancer cases, most HPV-induced cancer cases, and genital warts.

The strong performance and presence of Gardasil 9 in the US represent Merck’s strength in securing managed care access as well as the transition of customers to the 9-valent vaccine.

Contribution of Gardasil

Gardasil contributed ~5.4% of Merck’s total revenues in 2016, which is higher than its contribution of ~4.8% in 2015.

Overall vaccines business for Merck

Overall, vaccines sales were ~$5.8 billion in 2016, nearly 9% higher than 2015 vaccines sales of $5.3 billion. The growth was driven by all its products including the Gardasil franchise and Pneumovax.

ProQuad/Varivax also reported growth of 9% in its revenues for 2016 of $1.64 billion as compared to $1.50 billion in 2015. Also, RotaTeq sales rose 7%, while Zostavax sales fell over 9% in 2016.

Merck’s Gardasil competes with GlaxoSmithKline’s (GSK) Cervarix. GlaxoSmithKline has also acquired Novartis’s (NVS) vaccine business to strengthen its vaccines portfolio. Pneumovax competes with Pfizer’s (PFE) blockbuster product Prevnar 13.

To divest the risk, investors can consider ETFs like the PowerShares Dynamic Large Value ETF (PWV), which holds 3.3% of its total assets in Merck.