Mining Stock RSI levels: What the Indicators Suggest

NUGT and AGQ have seen YTD rises of 18.6% and 27.5%, respectively. But the volatility of such mining funds can be higher than that of precious metals.

March 30 2017, Published 12:36 p.m. ET

Leveraged mining funds

In this series, we’ll examine how mining funds and mining company shares have reacted to global indicators. Leveraged mining funds like the Direxion Daily Gold Miners (NUGT) and Proshares Ultra Silver (AGQ) are closely linked to the performance of precious metals—especially to gold and silver.

Specifically, NUGT and AGQ have seen YTD (year-to-date) rises of 18.6% and 27.5%, respectively. Often, the volatility of such mining funds can be higher than that of the precious metals themselves. Leveraged funds, in particular, have a higher level of uncertainty, and so they may not be suitable for all kinds of investors.

Mining stock volatility is important in the investor buying process. The mining shares we’ll examine below are Randgold Resources (GOLD), Yamana Gold (AUY), Pan American Silver (PAAS), and Coeur Mining (CDE).

Mining companies’ volatilities

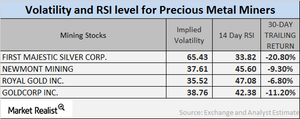

Call-implied volatility takes into account the changes in an asset’s price due to variations in the price of its call option. Remember, during times of global and economic turbulence, volatility tends to be higher than it is in a stagnant economy.

On March 28, 2017, the volatilities of Randgold, Yamana, Pan American, and Coeur Mining were 30.8%, 46.5%, 43.7%, and 52.6%, respectively. Remember, mining companies’ volatilities are often higher than that of precious metals.

RSI levels

A 14-day RSI (relative strength index) of above 70 indicates the possibility of a downward movement in a stock’s price. By contrast, an RSI level of below 30 indicates the possibility of upward movement in a stock’s price.

Notably, the RSI levels of the above four miners have risen due to their rising stock prices. Randgold, Yamana, Pan American, and Coeur Mining now have RSI levels of 61.2, 65, 65.3, and 57.7, respectively, and these four miners have all seen trailing-30-day losses—except Yamana, which has remained flat.

In the next part of this series, we’ll look at these companies’ correlations with the movements of their respective precious metals.